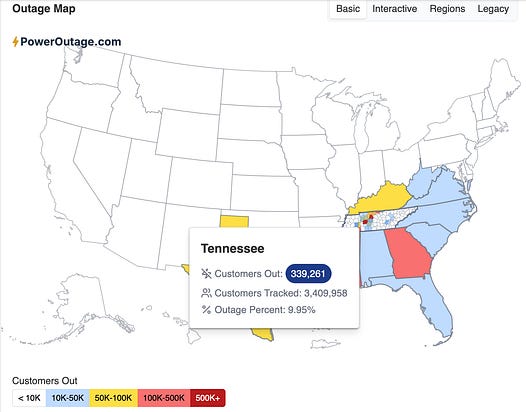

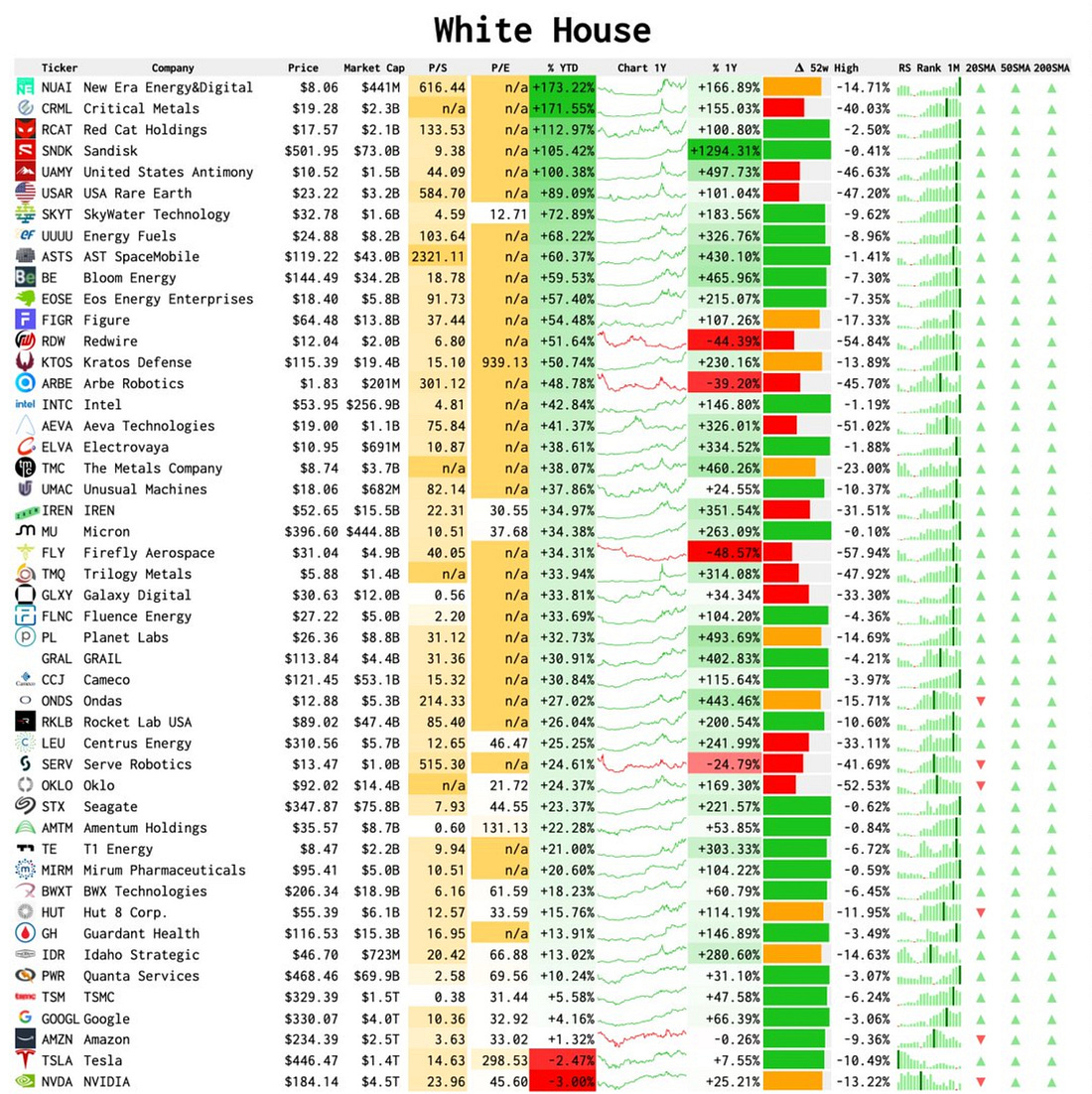

Do You Even Japan, Bro? (And Today's Market Focus)Everyone, everywhere in Maryland about to return their generators that they bought in the last few days...Dear Fellow Traveler: The power held up here at the farm… and we’ve avoided any serious strain. A hearty congratulations to PJM, our grid operator, for holding the line right now. But it doesn’t look so good down in Tennessee, where 10% of homes were out of power on Sunday afternoon when I started this analysis… We’ll see how many people return their generators in Maryland after buying them in panic last week... Watch Generac (GNRC) today and tomorrow. Expect some interesting swings up and down, as this was an absolute breakout momentum play last week. This could quickly spill over into overbought territory if the narrative on this storm shifts elsewhere. Let’s dig into the key things to watch this week… No. 1: Japan is a Bad TimeI said Saturday that the markets are waiting for Japan to intervene in the FX markets. This is timely given that I offered some insight earlier this week on how the relationship between the Yen and the Dollar impacts equity markets. Let’s step back really quickly. On Friday, the Japanese yen SPIKED at the end of the day. News broke that the New York Federal Reserve was calling around to ask banks about their yen exchange rates. This is all very boring on the surface, but it’s perhaps one of the most important things that will happen over the next 10 days - and that includes the upcoming Fed meeting and major tech earnings. Because it impacts the plumbing of the financial system. The yen had been sliding toward 160 to the dollar. That’s the line where Japanese authorities historically say “enough.” The Fed’s “rate checks” are basically just a cop slowly driving through your neighborhood. Nothing’s happened so far, but the world knows what comes next. The yen ripped 1.75% higher in a matter of hours. Its biggest move since August. The yen carry trade is the shadow funding mechanism for global risk assets. Institutions borrow yen at near-zero rates, convert to dollars, and buy everything from Treasuries to tech stocks to bitcoin. When the yen strengthens violently, those trades unwind violently. Remember August 2024? The Nikkei crashed 12% in a single day. U.S. markets followed. As I’ve noted, the Bank for International Settlements (the central bank of central banks) admitted that Japan and the U.S. are joined at the hip now There’s ongoing tension between Japanese fiscal expansion and American debt management. When those two forces collide, something breaks. So, we watch Japan closely. Prime Minister Takaichi is stuck. Her spending plans are pushing bond yields higher, which strengthens the yen's case for intervention. But intervention means selling U.S. Treasuries. Treasury Secretary Bessent is making noise about Japanese yields causing problems. Washington doesn’t want Tokyo dumping American debt. This is where it gets interesting. Some Japanese opposition parties want to tap the Bank of Japan’s ETF holdings and currency intervention reserves to fund tax cuts. That’s roughly $1.3 trillion in assets. The ruling coalition is pushing back hard. Using those reserves means selling U.S. Treasuries into an already fragile market. We are experiencing a shift in markets that’s been running for decades of low interest rates in Japan. It IS THE macroeconomic risk of our time. I’m not asking you to spend countless hours reading Bank of Japan briefings. I’m just telling you that when you see stocks like AIG falling out of the sky, or the FNGD breaking higher… and stocks heavily owned by leveraged funds dropping… I’m going to ask you to consider that the problem isn’t “stretched valuations” or "questionable earnings.” The story is in Japan. It’s been in Japan the entire time since at least mid-July 2024… (but really… for decades and decades…) No. 2: All Eyes on The PlumbersWe have to keep an eye on what’s happening in the Treasury markets. It’s not just about watching FX spreads. It’s really about the Treasury General Account ticking up as the Treasury Department keeps issuing new T-bills. This drains reserves, which is a contributing factor in the Fed's continued support. There’s about $80 billion in Treasury settlements coming up at the end of this month. And we’re going to be watching the repo market very closely all week. What’s interesting about this period is that our Momentum Signal is green, but we clearly see stress in various places. The FNGD is still above its 50-day EMA. Insurance names like AIG keep taking a hit. Regional banking stocks are under pressure. All the while, Michael Howell’s liquidity figure hit an ALL-TIME HIGH in January. But there’s not a lot of velocity in this equity market. This is going to remain a tricky quarter for equity assets. Tightening out of Japan would become a second liquidity drain as the Treasury takes hold. I continue to watch Bitcoin very closely. It’s down nearly 30% since October, and it’s just pure liquidity beta with no margin cushion and no earnings. Pay close attention to margin debt - still near record highs - because the growth rate of the balance is slowing. That’s significant. We’re still trading on headlines while the plumbing quietly tightens. EXERCISE CAUTION NOW… I KEEP SAYING THIS. ESPECIALLY IN FED WEEK. No. 3: Trumping This MarketA year ago, I pitched a newsletter at a meeting focused on the Trump administration’s influence on the economy. And to highlight the increasing theme of merchantism… and that Washington D.C. directs at least half of the economy. The big publishers didn’t want to do it. The editors shrugged... They said that they didn’t know how to sell it. It was called K Street Confidential. Scott and I pushed on this… wrote multiple versions… even gave away our ASML prediction (up about 50% since publication). The thesis was to focus on which policies benefited specific companies during the presidency of President Trump. It would have expired on the day that Trump left office… Now… LOOK at what has happened in this market on the stocks directly linked to polices and K Street… This isn’t hard. This is a massive monetary transition… My suggestion… take this whole list. Buy whatever is breaking above its 20-day EMA. This is pure momentum. Sell if it falls lower. Just scalp the policy trade. It’s not that complicated. And if anyone wants to launch a letter built around this premise, we still have three more years (And we can just end the letter when the Presidency ends in 2029). You tell me… ... Continue reading this post for free in the Substack app |

Home

› Uncategorized

Post a Comment

Post a Comment