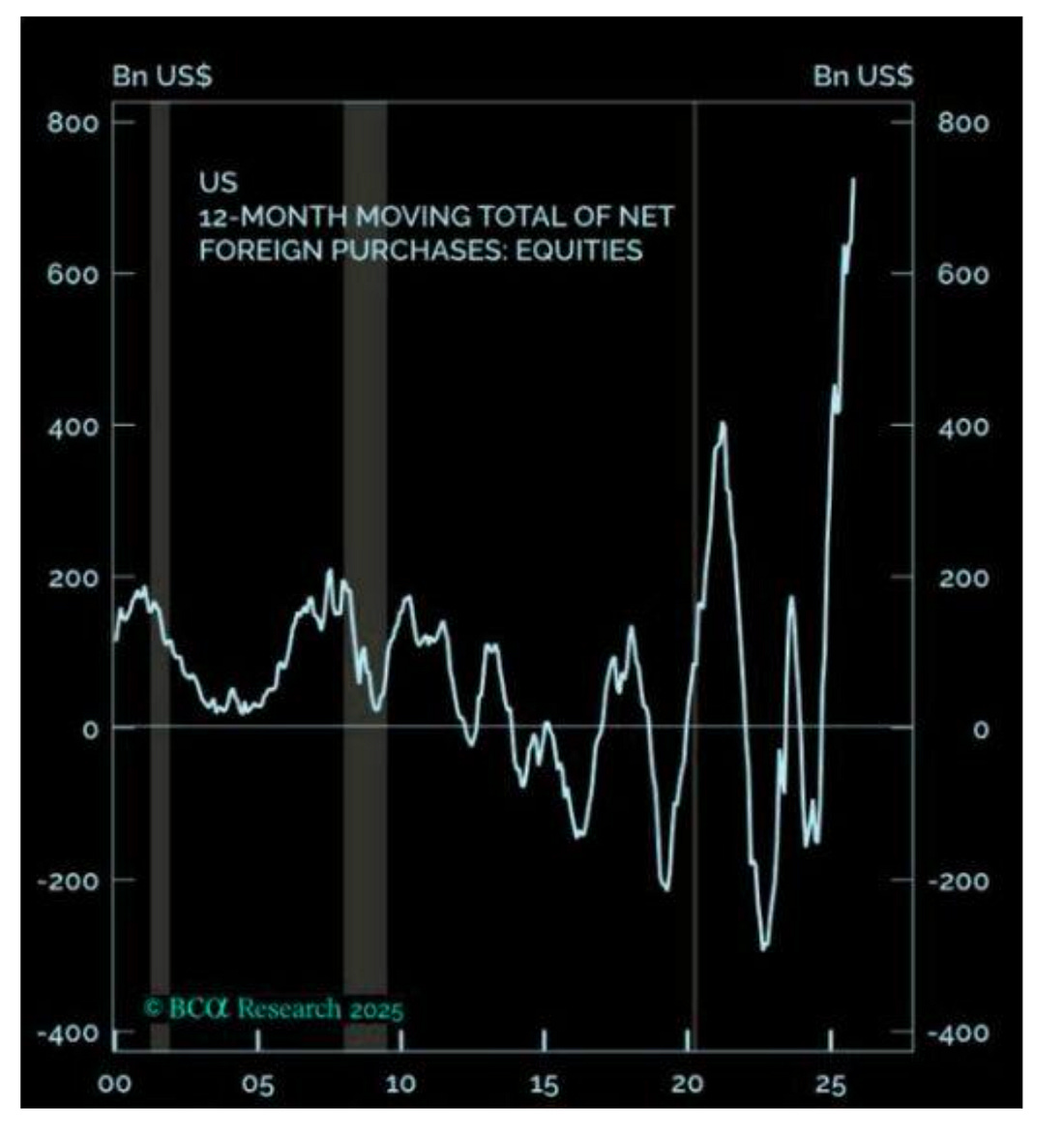

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: The Grey Shadow - the Honda HRV that I’ve been driving for 10 years - didn’t start today… Starter issue. It’s the second time this has happened in the last eight years… and the cost of replacing it… was… 124% higher than last time. Inflation is rough, man… As we look at today’s inflation report, a simple reminder. The things that matter keep going up. The cost of technology is where we see deflation that offsets many of the costs that keep rising… I’m glad that I don’t like cars. I can’t imagine driving something that’s as expensive as can be… only to have a headrest sensor go up and cost me $2,000… That happened to a friend of mine with a BMW in December. Cars are dumb… What else do I think? Thing I Think No. 2: In Josh We Trust…The Buffalo Bills go into Denver this weekend… and I have a very good feeling about it. In fact, so does Las Vegas. They’re the favorites on the road against the No. 1 team in the AFC. (A -1.5 spread means they’d be 4.5 favorites on a neutral site). Just gonna say this now… if they win this weekend… they’ll win the Super Bowl. And if they win the Super Bowl… I will not be at work the following day… I’ll be doing the Bull Dance and feeling the flow across the state of Maryland…. And crying… lots of crying… Thing I Think No. 3: Silver to $95Not sure what people are thinking… but all roads point to more monetary inflation… Silver and gold are moving higher… there’s no reason to short silver… None. Inventories are low, and China has export controls… all while the Federal Reserve is printing money… BRRRRRR. Thing I Think No. 4: The Most Dangerous Chart in FinanceThis is your risk over the next 24 months. It’s the net foreign purchases of equities in the U.S. Do you see how sharp that bid is? It’s nearly $800 billion… That $800 billion turns into leverage because passive flows and leveraged flows follow this chart. What happens when all that foreign money goes home? Valuation compression… it’s inevitable… So… watch the key moving averages of the S&P 500… and watch the FNGD. If it’s spiking, that’s leverage leaving the system. Foreign capital chases U.S. stocks because of Quantitative Easing and similar programs… but eventually… foreign traders bail. This is the source of the next financial crisis… Cross-border capital… I’m not telling you it’s gonna happen tomorrow. I’m just telling you that it’s going to happen. Watch our momentum reading because - again - a negative reading is a reflection of momentum breaking and liquidity leaving. All right! What a great time. No. 5: And Finally…Just a reminder… money printing drives stocks higher… money printing fuels speculation… money printing drives capital into equities as people look to defend themselves against more money printing… This is the Venezuela stock market… We’re going to get here at some point. Not tomorrow. Not after breakfast… But there’s a time in the next two or three years when the Fed will have to aggressively monetize our debt. What will that mean? A move above $10 trillion on the Fed balance sheet mixed with all-time highs. Again… follow our signals. All signs point to BRRRR… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment