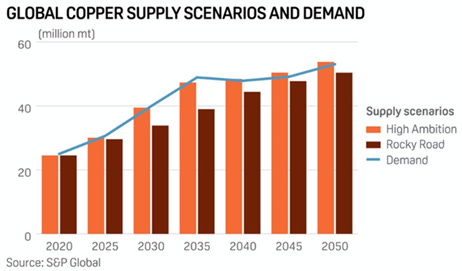

Postcards from the Edge of the World (Vol. 7)Every policy that is hoisted upon us eventually shows up in the price of one commodity...Postcards from the Edge of the World (Volume 7)To Whom It May Concern (You): Copper has become the map on which monetary policy, industrial policy, and political fantasy leave their fingerprints. The industrial metal shows us where dollar debasement, climate mandates, supply chain problems, and geopolitical rivalry all intersect in a single market. This is no longer just a metal behind wiring, motors, or home siding. It’s the material that reveals what the world is trying to do, and what the world can’t do fast enough. No other commodity carries this much political weight while remaining this difficult to substitute. And while oil remains the center of the policy universe (as evidenced in recent weeks), copper will be the metal that creates increasing tension in an increasingly multipolar world of Chinese and U.S.-influenced nations. I call this theme The Copper Ledger. It’s the audit trail of political ambition. Every mandate, subsidy, and infrastructure bill… Every promise made by a politician about the future of energy is eventually reflected in the price and availability of one thing: Copper. Politicians don’t read this ledger. The market does. You do… I do… Reflect on the last few decades, and you’ll see a pattern. Policymakers convince themselves that intentions can outrun constraints. Remember how price controls would manage inflation? Remember how Post-Cold War optimism was going to pay for itself? Remember how people thought we could engineer our way out of subprime risk? Or the people who said that central bank balance sheets no longer mattered? Those politicians have been wrong for decades, and what do fools do? They triple down. We’re now told the entire energy system can be rebuilt on a political timeline (we’ll be net zero by Copper prices are the expression of that delusion. States have legislated an electrical future before securing the metal to power it. That belief hits resistance in copper. And this year, the collision is accelerating. AI power loads are spiking. China’s liquidity cycle is bottoming and preparing to turn. Natural gas appliance bans are spreading. The gap between what the world demands and what the world can supply is widening faster than anyone in Washington wants to admit. The strain is no longer a guess… This is all showing up in prices, project delays, and transformer shortages. Last week, I wrote about Amazon and the nature of chokepoints. I centered on how the company builds infrastructure, forces dependency, and then monetizes the chokepoint. Copper is the same story, except the chokepoint was not built by a corporation… It was built by geology. And no amount of policy ambition can change the fact that the world needs more of this metal than it can currently produce. The Ways They TakeThe extraction mechanism this week is not hidden in some obscure corner of the financial system. It’s sitting in plain sight, embedded in every policy document, every stimulus announcement, and every mandate coming out of Washington, Brussels, and Beijing. Every time a government announces another round of grid modernization, EV subsidies, or AI infrastructure spending, they’re placing a bid on copper. They don’t frame it that way. They frame it as “progress” (my least favorite word out of a politician’s mouth). But copper doesn’t care about framing. Copper only cares about tonnage. It’s an inanimate object… The causal chain is simple… Policy mandate creates electrical load… Then the electrical load requires grid hardware… Then the grid hardware requires copper. This is a chorus of transformers, substations, transmission lines, and charging stations. And all of it flows through the same narrow pipe… that will only get narrower. S&P Global now projects global copper demand will jump from roughly 28 million metric tons (MMTs) today to more than 42 million by 2040. The numbers get more insane as ambition levels increase… That’s an increase of roughly 50% in less than two decades. So… what’s driving all this? All the headlines. AI data centers are drawing gigawatts. EV adoption continues even when the auto cycle softens. Wind, solar, battery storage, transmission lines, and defense systems are all being bid out. All of these things pull copper into the center of the economy. Forbes says that a traditional data center requires roughly 5,000 to 15,000 tons of copper for the facility and its grid connection. One EV contains three to four times as much copper as an internal combustion engine (ICE) vehicle. (And then they claim these vehicles reduce carbon emissions without ever considering how much carbon you burn from mining all this stuff). A single offshore wind turbine needs more copper than most people will touch in a lifetime. But the world isn’t investing at a pace that comes anywhere close to meeting it. That leaves a supply gap of somewhere between seven and 10 million tonnes. We have seen this problem before. Between 2006 and 2011, copper prices surged as China’s infrastructure boom collided with constrained supply. Then commodity investment collapsed after 2013, and the industry spent a decade underbuilding. Now we’re entering a demand surge, with a supply base starved of capital for years. The Copper Ledger remembers what the policy documents forgot. The system takes by pushing mandates that require more metal than the world can produce. They don’t call it extraction. They call it “transition,” “modernization,”or and “infrastructure.” They scream “progress” - which has all the same feel as the word “forward” while standing on the edge of a cliff… Nearly every major utility rate case filed this year includes copper costs passed through to ratepayers. The increasing bill shows up in copper… as always. What’s Beneath the NoiseCopper demand is no longer cyclical. It’s now structural. That’s a massive change in the recent history of economics… This is not a commodity story that turns with inflationary expectations. It’s a shift in how the world uses electricity. Reuters says that AI data centers alone saw more than 100 new projects last year. Technology.org says that it was about $61 billion of investment in those locations. The conflict in Ukraine and moves by Japan, Germany, and others to increase defense spending are likely to further fuel copper demand. The politics of the energy transition have changed dramatically. S&P Global no longer even frames this as a “net zero” story. They frame it as a structural demand that will rise regardless of government climate policy. Demand doesn’t need environmental policy to accelerate. It just needs the world to keep doing what it’s already doing… It’s electrifying, digitizing, and militarizing. Nearly every electronic device contains copper. But the politics are wild… Chile and Peru are the largest copper miners. China is the largest copper smelter, refining more than half of the world’s output. Smelter capacity is running near limits while ore grades keep falling. That concentration is not an accident. It’s a strategic weapon. The U.S. imports half of its copper needs each year but lacks real smelting capacity that would be considered “self sustainable.” That’s the supply chain politicians never mention when they announce their ambitions. Copper tells you what is happening in industrial activity before the economists finish their models. When copper moves, pay attention. It’s usually right. How Power Really WorksPoliticians issue mandates they never personally have to deliver on. Since they never have to lay a mile of transmission line or build a substation, they assume the materials appear by magic. These people need medical help. Corporations do care about limits, but their incentives are just as distortive. AI companies promise compute growth that requires power loads that we’ve never seen at the civilizational level yet… All while everyone is chasing money wherever they can get it (rent-seeking). Utilities chase federal money. Automakers chase subsidies. China chases industrial stability. Copper sits at the center of that chase. Then there’s the other side of what people ignore… Dollar policy magnifies the pressure. When central banks debase the currency to smooth volatility or engineer “soft landings,” the debasement shows up in the materials that are hardest to substitute. The Fed prints liquidity. Copper is one of the few assets that immediately convert monetary distortions into real-world price signals. You can ignore the Fed’s language. Copper will tell you before the economists do whether the money supply is too loose. Michael Howell at CrossBorder Capital has been tracking these liquidity cycles for decades. His latest analysis shows the Chinese liquidity cycle bottoming right now, in late 2025, and poised to expand significantly into 2026. The correlation between U.S. and Chinese liquidity cycles is currently at a near-record negative. When China’s liquidity expands while the U.S. tightens, commodities spike because China injects liquidity into the real economy, not the financial plumbing. It happened in 2006, 2009, and 2016. The pattern has not broken yet. And based on the current cycle timing, it’s starting again now. The geopolitical chessboard makes this worse. Chilean political instability has already disrupted output. African supply is emerging but unreliable. Russian sanctions have tightened flows. And China’s refining dominance means that even when copper is mined elsewhere… Beijing still controls the processing. The U.S. lacks the smelting capacity to meet domestic demand. That’s a massive vulnerability… and we have no plan (lawyers will sue to stop any new smelting because of the environment…) If China eases further, copper jumps... If the Fed pivots to cuts, copper will price it before the bond market does. If the U.S. forces electrification mandates into 2035, copper becomes the inflation engine nobody budgeted for. And producers will have the right to hold a nation hostage because of “mandates.” The Everyday Hustle“We used to make shit in this country, build shit. Now all we do is put our hand in the next guy’s pocket.” — Frank Sobotka, The Wire If you’re wondering why your electric bill is rising, why your city keeps raising utility rates, why grid upgrades never seem to finish, or why new construction is suddenly so expensive, this is the reason. You’re not paying for electrons. You’re paying for metal. The metal is embedded in every household expense that touches electricity. Your rate hikes are not just inflation. They’re the downstream cost of running policy ambition into material scarcity. Consider the rising costs and bottlenecks in manufacturing heat pumps, transmission lines, substations, EV chargers, and battery storage. And, of course, transformers, the workhorses of the electrical grid. They require copper in quantities that utilities did not plan for. When a state bans natural gas in new construction, the cost of that ideal does not appear in a press conference. It arrives, though, in copper pricing. When governments offer tax credits for EVs, the real cost shows up at the smelter. When AI firms break ground on new compute clusters, copper tightens long before anyone worries about electricity bills. The market is reflecting the physical requirements of the policies being pushed through it. And those costs are just beginning. The Real EconomyEvery significant economic power is now pushing more electricity into the system. The U.S. wants to rebuild the grid. Europe wants more renewable generation. China DEMANDS industrial stability. Corporations want to build more data centers, while voters want cheaper energy. No one is asking whether the material base can match the political ambition. The question is being answered anyway. The hidden victims are already piling up. Homebuyers are watching construction costs surge (buying MBS doesn’t lower housing prices, by the way). Small manufacturers are watching margins compress. Contractors are eating cost overruns as utilities are requesting emergency rate hikes. Cities are delaying grid projects (which is going to create blackouts in the years ahead). The metal has become the ledger where the world’s promises meet the world’s constraints. Mining capacity does not respond quickly. New projects take a decade or more. Ore grades keep drifting lower. Permitting is slower than the tectonic plates that formed the deposits in the first place. Social and political pressures (and ****ing lawyers) make it nearly impossible to build new megaprojects in the West. And the regions that supply most of the world face their own political volatility. We’re not short of copper today due solely to smelting disruptions. We’re short copper because the world didn’t invest in long-term production while it was busy talking about climate goals. This is an echo of the last copper supercycle, except demand is far greater, and supply is far more constrained. Lithium supply chains are fragile. Silver demand for solar is accelerating. Uranium is repricing as nuclear power returns to fashion. Transformers themselves have become a bottleneck within the bottleneck. The world has more chokepoints than voters realize. And while every commodity has its politics, copper has no substitutes. It’s the one that touches everything. The future the world wants cannot be built without copper. The future the world has cannot afford the copper it requires. That’s the tension defining the next two decades. The Back PageYou’re being told the energy transition will be smooth, affordable, and inevitable. That’s fiction at best, and a political lie at worst. What is unavoidable is the bill that’s written in copper. We legislated an electrical future before we secured the metal to power it. Every mandate is a claim on a material the world does not have enough of. Every new target is a tax on your cost of living. Every political timeline is a bet that physics will not object. Physics is objecting. And nobody in power wants to talk about it. You can’t legislate ore grades. This is a chokepoint. And chokepoints collect rent from everyone who must pass through them. By 2027, copper shortages will be a mainstream political issue. The only question is whether you positioned yourself before or after the rest of the world figured it out. The Sovereign MoveYou can try to reduce your exposure to the copper squeeze. You can resist the idea that every home must electrify on a schedule written by people who have never seen a transformer. You can reduce your forced reliance on the grid. You can avoid big-ticket electrified appliances simply “because the policy says so.” But you can’t avoid the structural reality. Copper is tied to the direction of industrial civilization. You can buffer yourself, not escape it. That leaves the matter of sovereignty. If you can’t avoid the bottleneck, the next best move is to own the people who profit from it. You regain leverage by owning what the system can’t function without. You can’t outvote a chokepoint. You can only position yourself on the right side of it. This is the chokepoint that will define the next two decades. The world is pushing into a bottleneck that only a handful of companies are positioned to relieve. One of them is… this stock…... Continue reading this post for free in the Substack app |

Home

› Uncategorized

Post a Comment

Post a Comment