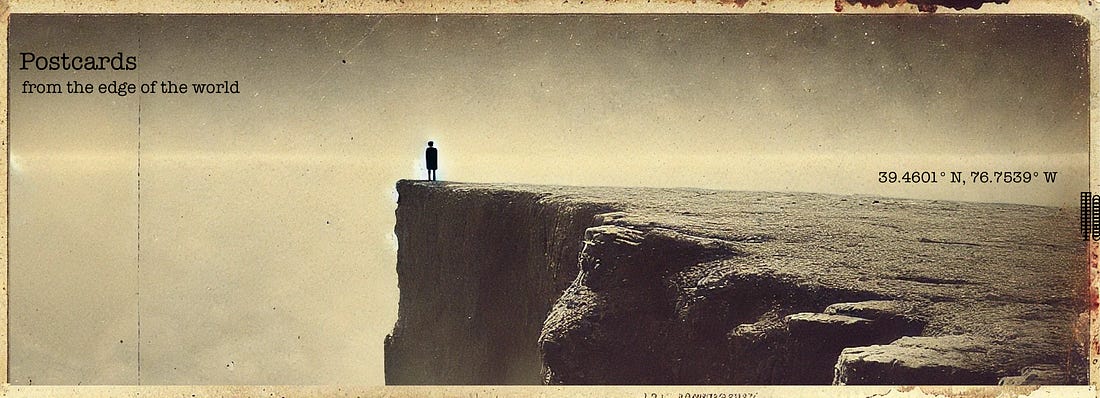

Postcards From the Edge of the World (Vol. 8)It's the one asset that survives all time, all generations, all wars... and all bad men.To Whom It May Concern (You): Let’s go back to 1066. October 14. A single arrow is shown piercing the eye of King Harold just before sunset. That’s what the Bayeux Tapestry suggests. Once Harold fell, the English shield wall collapsed, and the Norman victory became inevitable. Historians still argue about the details. Accountants, on the other hand, rarely do. It remains debated whether the man clutching the shaft is Harold or whether Norman knights cut him down instead. No one argues the stakes or the outcome. England changed hands. William, the Duke of Normandy, had made a massive gamble. He’d crossed the English Channel with roughly 7,000 men aboard hundreds of ships. The soldiers included second or third sons with little to inherit. Some were minor nobles, while others were mercenaries who believed they might find better futures by staking their lives on William’s disputed claim to a foreign throne. The soldiers swallowed cold rations the night before this battle. They looked up at a ridge where Harold’s army waited, holding the high ground. They faced a fresher army holding a defensive position. They’d have to charge uphill into a shield wall. During the following day, the Norman cavalry attacked in waves. Harold’s elite warriors, the housecarls, stood shoulder to shoulder, their shields interlocking. Their two-handed axes could smash a horse’s skull with a single swing. On at least two occasions, the Norman lines broke and fled down the hill. At one point, William tore off his helmet and led the charge, bearing his face to show he still lived. “Look at me! I live!” he shouted to maintain his troops’ morale. “And with God’s help, I shall conquer!” As the evening approached, the grass turned to mud mixed with blood. Charging horses stumbled over the dead as they rode uphill one last time. By nightfall, with Harold gone, the Norman Conquest had begun. William’s victory triggered one of the most dramatic reallocations of wealth in recorded English history. It wasn’t just the throne he took. He claimed nearly everything across England. Over the next two decades, the estates of Anglo-Saxon elites were transferred to Norman followers. The Domesday Book of 1086 documents this transformation. Before 1066, Anglo-Saxon nobles controlled most of England. By 1086, fewer than 5% remained among the major holders. This was less a succession crisis and more a hostile takeover. The assets had been transferred to a few hundred Norman families, including names like Percy, Mandeville, Montgomery, and Flanders. And who could forget “Baldwin the Sheriff,” a name that sounds like a character in a Monty Python sketch. What’s incredible about this isn’t how fast the 1086 transfers happened. It’s what has endured for over 900 years... England’s aristocracy has remained incredibly durable. Individual families rose and fell. Don’t forget the Cavendishes (a great name for a BBC Comedy show). But the structure of elite continuity survived civil wars, religious upheavals, and political revolutions. Titles changed hands, while estates were subdivided, sold, and later recombined. But the organizing asset of elite success has remained the same. The aristocratic structure survived the Magna Carta and went untouched during the Wars of the Roses. Nothing shook up their wealth systemically during the reign of Henry VIII or the English Civil War. They got through an Industrial Revolution, two World Wars, and even the Death Duties, laws specifically designed to eliminate large amounts of inherited wealth across England. Political movements came and went, but paperwork stayed consistent. If you examine the research, the pattern’s difficult to ignore. Economic historians studying surname persistence find the same pattern… Descendants of Norman-era elites with Norman-derived surnames are disproportionately represented at Oxford and Cambridge. They still appear among the higher social elite at the Royal Ascot races and in the House of Lords. This persistence is structural, not genealogical. It’s been less about unbroken bloodlines and more about who controlled one asset class across generations. What is it, and how can you own it too? Across TimeTo answer this question, we travel to Germany, 1744. Mayer Amschel Rothschild was born in the segregated Frankfurt Judengasse, or historic Jewish ghettos. Rothschild had started his career as a coin dealer. His reputation had reached Crown Prince Wilhelm of Hesse. When Napoleon arrived, Wilhelm fled, leaving behind a fortune. Rothschild hid it, managed it, and grew it. That loyalty built a dynasty, with five sons in five capitals. They established an international bank, financed nations, wars, railways, and the Suez Canal. Later accounts claim Nathan received news of Waterloo earlier than most officials, though historians still debate that advantage. Soon after, they began converting a large portion of their fortune into other assets, often outside the immediate reach of political power. History shows that when governments get loud, prudent families get portable. The Rothschilds rose to prominence through finance, but like many enduring dynasties, they steadily diversified into hard assets. Their modern wealth is fragmented across branches and jurisdictions, often held through trusts and foundations. The banking empire faded, but a core asset base, estimated in the tens of billions across regions, has endured. Now to Rome, 200 BCE. Roman senators were the wealthiest men in the Mediterranean. The Cornelii, Aemilii, and Claudii controlled the Republic and commanded legions. Their fortunes came from conquest, tax farming, and lending at brutal rates. The Gracchi tried redistributing their wealth, and both were murdered. Caesar challenged their power, and then was stabbed 23 times. The Republic collapsed, and the empire endured with several civil wars and emperors losing their control. Roman currency was debased 90%, and Christianity replaced the old gods. From a portfolio perspective, it was a difficult quarter… over and over for at least 400 years. When historians examine surviving elite offices and property records from the late Roman period, they find a remarkable pattern of continuity. Some lines faded, while others persisted. The political system changed entirely. But across civilizations, elites who survived collapse rarely did so by clinging to offices or currencies. They survived by maintaining control over productive assets and social networks that could survive and function under multiple regimes. One of those assets has endured since the time of the Roman gods. The gentry of Cheshire weren’t dukes or earls. They were the quieter families who dominated local counties for eight hundred years. Some traced their position to the Norman Conquest. Agricultural prices collapsed after Napoleon. And families went bankrupt across England. The Industrial Revolution shifted power from the countryside to cities. Factory owners became the new money. The gentry were supposed to fade into irrelevance. Death duties were introduced in 1894 specifically to break up inherited wealth. Each generation was forced to sell. But the gentry adapted and endured. Researchers find that families that were wealthy centuries ago remain statistically more likely to be wealthy today. The correlation persists across generations. What was their secret? Across CivilizationsBy 1860, the Southern planter class had built one of the wealthiest agricultural economies in history. Cotton was America’s largest export. The planters were among the richest people on Earth. Then General Sherman arrived. The March to the Sea was 60 miles of destruction by the Union Army. They burned mansions. After the war, slavery was abolished in the United States. Confederate currency became worthless, and Union troops occupied the region for a decade. But by 1900, census and tax records analyzed by economic historians show something striking. The sons of wealthy slaveholders had, on average, recovered economically relative to regional populations. The surnames on tax rolls showed remarkable continuity with antebellum records. Over one generation, the recovery came through political control, credit access, and one asset they never lost. History is often brutal, and its outcomes are rarely accidental. The Medici were wool traders in the 1200s. They weren’t anybody special. Giovanni founded the Medici Bank in 1397. They became bankers to the Vatican, the rulers of Florence. They produced multiple popes. But here’s what most miss. Before the bank, they were already a critical asset in the 1260s. This accumulation began before Giovanni and long before the family acquired political power. The bank collapsed in 1494, largely due to bad loans to monarchs who later refused to repay them. The family still ruled Florence for another 250 years. Financial innovation is exciting. Longevity usually comes from elsewhere. The French aristocracy was supposed to die in 1789. The guillotine fell regularly. Estates were confiscated, and survivors fled across every border. The Terror was designed to eliminate them as a class. Today, by some estimates, thousands of families still claim noble status despite the Revolution. Many saw it coming. They converted their wealth into something harder to confiscate. Others, after the chaos, bought back what they’d lost. A Pattern in Plain SightThese examples span multiple groups. They stretch across different centuries, continents, and political systems. It doesn’t matter who you choose. Norman knights. Jewish coin dealers. Roman senators. Southern planters. Florentine traders. French nobles. And those are just a few examples from which I selected. The same pattern repeats itself. Trade built the fortune, banking multiplied it, and political connections protected it. But when the moment came to preserve wealth across generations and centuries, even as everything else collapsed... it was this specific asset. What follows isn’t an endorsement of hierarchy or a defense of how wealth was acquired. This is a deeper observation about which inputs survive regime change, moral revolutions, and financial resets. Again and again, the same asset class reappears at the end of collapses. It wasn’t gold, because gold produces nothing. Not currency, which is just a political promise. It definitely wasn’t bonds or stocks... Bonds are loans to governments that might not exist, and corporations can be nationalized or bankrupted. It was something that existed before governments, that produced without their participation, and that no one can print more of. I Want to Own What EnduresYes, the ancient secret turns out to be land… Some Norman families still possess estates granted in the aftermath of 1066. A small number of families own a disproportionate share of England. The Rothschilds invested in Château Lafite, Château Mouton, and Waddesdon Manor. They have hundreds of properties across Europe, some owned through foundations and trusts. The Roman senators bought farms across Italy, Egypt, Spain, and Gaul. Elite families held productive agricultural territory across centuries of political chaos. The Southern planters kept the land. The Medici bought villas across Tuscany, across 16 major properties. The bank failed, while the villas still stand today. The French aristocracy held Bordeaux, Burgundy, and Normandy. While they lost a lot in the Revolution, they knew how to repurchase it later. Across empires, political systems, and technological revolutions, the same asset repeatedly emerges as most capable of surviving regime change. Not because it is immune to confiscation, but because it can be hidden, subdivided, leased, transferred, reclaimed, and repurchased when chaos passes. Ownership has shifted, but control has endured. For more than 2,000 years, the same RULE keeps reappearing as civilizations change… Own the freaking ground. Land Over SoftwareThis is a hard lesson for retail investors and day traders. But the people who manage generational wealth… and the institutions that think in decades? They know what preserves real wealth. Bill Gates is now America’s largest private farmland owner. Through his investment vehicle Cascade, he’s bought 242,000 to 275,000 acres across roughly 19 states as of recent filings. He's in Louisiana, Arkansas, Arizona, Nebraska, and Washington. When asked why, he gave a simple answer: “Farmland is an important asset class that will maintain its value and purchasing power over time.” He’s not alone. Global farmland investment is booming. In 2025, investment was slated to hit about $60 billion, up from $40 billion in 2020, according to Farmonaut. Sovereign wealth funds, the investment arms of nations, are allocating record capital to agricultural assets. Qatar’s sovereign wealth fund holds massive stakes across Australia, Russia, Argentina, Brazil, and Uruguay, both directly and indirectly. Abu Dhabi’s ADQ controls over 167,000 hectares in Sudan, owns 45% of Louis Dreyfus Company with its massive Latin American holdings, and holds majority stakes in fruit operations across Chile, Ecuador, Argentina, and the Philippines. The Canadian Public Sector Pension Investment Board holds over 4 million hectares of natural resources, including millions dedicated to farmland and agricultural land. TIAA and Nuveen manage over $11 billion of farm assets. The Ontario Teachers’ Pension Plan bought the 6,175-acre Broetje Orchards in Washington. These aren’t speculators. They’re institutions with mandates to preserve wealth across generations. They’re buying what the Normans took, what the Rothschilds converted to, and what Roman senators accumulated. Dirt. Now… there’s a bonus in all of this… something I want to stress. There’s usually something hidden inside, and if it’s this resource, you really have something special. The Mesopotamians understood it 5,000 years ago. The Sumerians built connections between the Tigris and Euphrates for it. This resource helped create civilization, and it later became one of the primary causes of war. Control this, and you control which fields produce and which turn to dust. The Egyptians understood. The Nile enabled continuous cultivation for 5,000 years. Nowhere else comes close. California is learning the hard way now. The Sustainable Groundwater Management Act is rewriting property values. Land with senior rights to this asset trade at a premium. Land without reliable access is increasingly abandoned. The difference between a $42,000-per-acre orchard and worthless dirt is access to one thing. Water… In California, cities often pay hundreds of dollars per acre-foot, while agricultural districts pay a fraction of that. In drought years, spot prices exceed $2,000. The families who survived millennia didn’t just own soil. They owned soil with water. Now… let’s start to talk about what you can do about all this… The Sovereign Household MovesIf you can’t own these chokepoints, claw back the benefits. The system extracts through metering, volatility, and forced participation. You don’t beat it by opting out. You beat it by fixing costs, shortening chains, and buying time. These are moves people can actually make. These are not lifestyle hacks. They’re defensive moves against systems that price volatility. 1. Turn Variable Costs Into Fixed Ones Prepay for food where possible through CSA shares, meat shares, and bulk staples. Lock in annual service contracts for trash, lawn care, snow removal, and pest control early. Buy household essentials quarterly, not weekly. Extraction hides in floating prices, and fixed costs starve it. 2. Shorten Supply Chains to Reduce Toll Layers Choose farmers’ markets over grocery chains, the local butcher over national meat brands, and regional dairies over multinational processors. Every intermediary is a toll booth, and the closer you are to the source, the fewer hands take a cut. 3. Eliminate Usage-Based Pricing Wherever Possible Audit your utilities, including electric, gas, water, trash, recycling, auto insurance, and internet and phone plans. Switch to flat-rate plans, avoid tiered or “dynamic” pricing, and lock rates when offered. Meters are extraction devices. Flat pricing restores predictability. 4. Convert Recurring Fees Into One-Time Ownership Buy tools instead of renting. Kill maintenance plans that never pay off. Choose appliances without subscriptions and with basic repair capability. Recurring fees compound, but ownership caps exposure. 5. Build a Timing Buffer Keep 60 to 90 days of essentials you already use, rotate them once per year, and focus on boring basics rather than novelty ones. This lets you choose when to buy. Timing control is a critical form of financial control. 6. Reduce Dependency on Fragile Systems Maintain manual backups for basic needs, offline copies of documents, and simple backup options for cooking, lighting, and power. Resilience is cheaper before disruption than after. 7. Kill Convenience Premiums Audit delivery fees, app markups, subscriptions you forgot existed, and “service” and “processing” charges. Consolidate to fewer platforms, fewer subscriptions, and one weekly errand run. Convenience is now a luxury tax. 8. Track Essentials Like a Business Expense Review food, utilities, insurance, transportation, and medical expenses monthly. You cannot defend what you do not measure. This isn’t budgeting. It’s surveillance. 9. Separate Survival Money From Market Money Keep 90 days of bills in cash or T-bills. Never rely on selling assets to cover necessities. Treat liquidity as insurance, because forced selling during market downturns is extraction at its worst. 10. Ask One Question Before Every Expense Does this make me more dependent or less? If it increases dependence, it will get more expensive later. When systems tighten, survival isn’t about owning everything. It’s about fixing costs, shortening supply chains, and buying yourself time. That’s the doctrine. The Investment PotentialNow, we move on to our stock pick… although this isn’t structured like a traditional equity. It’s a tax-efficient asset class that enjoys many of the benefits that were historically reserved for the wealthiest investors. Early last decade, a company went public on NASDAQ that changed American history… And it becomes our next Sovereign Investment Idea for the road ahead... Keep reading with a 7-day free trialSubscribe to Postcards From the Edge of the World to keep reading this post and get 7 days of free access to the full post archives. A subscription gets you:

|

Home

› Uncategorized

Post a Comment

Post a Comment