You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Raising the Yellow Flag... (It Shouldn't Be THIS Easy)Welcome to the "Viagra and Popsicle Stick" market... and my Will Emerson moment...

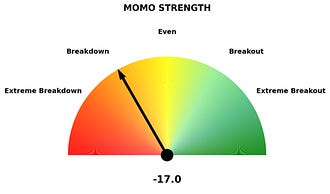

Dear Fellow Traveler: We’re negative on intraday reading… slightly green on S&P 500 and turning yellow on the Russell 2000. Selling pressure is picking up on the Russell… and it’s right at the edge where I start to get a little worried. Breadth is weakening… 41% of stocks are now under their 50-day moving average… I’m closing the shutters. (I’m not calling a top. I’m calling a timeout.) Let me start here… I’m not bragging about what I’m going to tell you since Scott and I wrote the Hedge of Tomorrow… I had a sizeable position in materials - especially silver and gold. We’ve been long gold since $2,100 an ounce and silver since $25 an ounce. On the record… and pointing to the road of more monetary inflation. I’m having ANOTHER “great day”. again because of this 14% move in silver. But I don’t actually feel like I’m making money. My cash positions are getting hit… and something’s wrong structurally. The metals are saying something… they’re telling me we’re in a different world now. They’re telling me not to be comfortable… and NOT to celebrate. I don’t feel richer. I feel… like my head is above water. The only time I’ve felt like this when it comes to “Wow, it’s been so easy to make money by doing this…” (and the this is just keep buying Silver)… Was 1999-2000. It was when I was learning about the markets for the first time, and buying a tech infrastructure company called Digital Island. It went from like $5 to $160 and then went bankrupt a year later. Young Garrett learned a valuable lesson on greed and FOMO back then. Now, he’s a tad wiser. No one ever got poor by taking profits. The way I think about it… The mortgage is covered for a while… What Is the Upside Over the Next 45 Days?What I learned then I have to apply now. And I get conservative when we start to see these types of moves. I’m not selling any physical silver, but I’m gonna start taking some profits on CEF, SLVR, and PHYS, and my miners… and then setting stops on the rest of the positions. It’s been a run. Over at Postcards from the Edge of the World, we recommended CEF at around $44.00 per unit. It’s up 37.6% in in less than 40 days. That’s not an investment. That’s a BIG RED FLAG that something is wrong in the markets. Silver and gold should not be moving like this, but we’re in a generational paradigm shift. I’ll take some gains… leave about 60% of the founding principal, hope it runs, and then set tight stops as we sit on the verge of a major central bank shift. Which is why I think our dataset could experience some shifts… and why I think markets just aren’t prepared for sudden surprises. This is getting manic. I've only done this a few times since I have been covering liquidity and momentum… The first was when we went dark on data in February 2022 because of a cybersecurity event. We bled off all February of that year… which is historically the second-worst month for markets. The second was March 2023 - when we got a strange reading on banking stocks out of nowhere… Then, a few days later, SVB blew up. And there was February 2025… ominous… Liquidity is under pressure. It’s obvious. So, I’m gonna just err on the side of caution. I was reading an article on ZeroHedge this morning, and it just rubbed me the wrong way. It warned of “Serious Downside Convexity…” “Downside convexity…” DRINK! Let’s ExploreLet me really water down what is happening right now… Right now, the biggest risk in the market isn’t about the news or the economy. It’s about how the market reacts when prices start moving. A large part of today’s market is run by automatic systems. The algos and systems don’t read headlines or listen to the Fed. They follow basic rules, built around key technicals and specific conditions. When stocks are going up and things are calm, they stay invested. When stocks start falling or moving faster, they pull money out. At the moment, those systems still have a lot of money in the market. We’re so overexposed to equities that things can go wrong, and we can cascade and sell VERY FAST. At the same time, the market has been losing energy. Imagine what this market would look like without the Fed injecting $40 billion a month… or Japan stimulus… or European shadow banking support… or short-duration focus on Treasury Bills. It would be a CASCADE. Momentum is stalling despite record levels of liquidity in the financial system. This stock market is in “Viagra and Popsicle Stick” mode. The market looks upright, but only because it’s being held there by policy support and liquidity scaffolding. Risk right now isn’t that stocks are “too expensive” or that a company misses earnings. The risk is what happens if prices start sliding. If money leaves the U.S. because Japan's rates are in focus… and leverage unwinds and passive flows stall for just a week or so. If the market drops just a little from here, those automatic systems can begin selling. As they sell, prices fall faster. As prices fall faster, even more selling gets triggered. The move feeds on itself. This is how markets can drop quickly without any big piece of bad news. Nothing dramatic has to happen. The market just needs to start moving in the wrong direction, and the mechanics take over. That’s what people should be paying attention to right now. I don’t do this very often. Maybe once a year… (February 2025 was the last time) But with the Fed meeting in play… weakening buying pressure on the S&P 500, and Japan being Japan… I’m gonna hedge nearly everything. With all this support in the repo markets, Japan stimulus, and ongoing support, this market is STILL teetering. It feels like the storm before the calm… The calm would be driven by a policy change. And it feels like we’re fast approaching something bigger than just FX intervention. We might be discussing a Plaza Accord-style action to backstop currency markets. It’s part gut, and part data… It starts with the second part… and shifts back to the first. I remind you to do the exercise - again - of answering five questions… You Have QuestionsLast week, I encouraged everyone to conduct an audit of their portfolios. With equity markets still clearly on edge due to Japan’s non-stop volatility engine, it’s important to play defense and stick to the long-term Hedge of Tomorrow plan… That said, I received an email from a paid subscriber… and the questions deserve some insight. Here are the questions… from Charissa…

The questioner concludes: “Sorry for the dumb questions. I am new here and learning more each day. Your work is answering the questions that have been haunting me in recent months.“ My reply below… Readers…I have to work backward on the message. First… these are not “Dumb questions.” These are the questions many people fear asking. You see, the financial industry has spent decades trying to make people feel like morons because they don’t understand the concepts that they’ve deliberately kept confusing or difficult. You don’t need an RIA to manage your money. You need time, patience, and rules. Complexity is part of the industry’s job security. The fact that someone is asking these questions now, rather than after the market does… is the point of my article last week. So, let’s move into the reader’s questions. 1. How does time frame factor into this equation?Time frame matters, but not in the way most people think. Most investors use “long term” as a substitute for actually thinking. It becomes a permission slip to stop paying attention. They tell themselves that retirement is 15 years away, so whatever is happening right now doesn’t really matter. That’s how people end up holding garbage all the way down and wondering what happened. And it’s how you get blown up in a paradigm shift. Time doesn’t neutralize liquidity risk, and it doesn’t protect you from forced selling. If a company can’t survive the next six months without the market remaining friendly, it’s not safe just because you swore to hold it for a decade. Time does help, but only after a position has already passed the stress test. It works when a company can fund itself without having to beg the capital markets for money every quarter. Think of the time frame not as a shield, but as a multiplier. It amplifies whatever you already own. Good companies get better with time. Fragile companies just get more chances to blow up... 2. What about corporate bonds? What allocation makes sense, and how do I tell good ones from bad ones?Corporate bonds sound conservative. Your financial advisor probably put them in there and said something about “stability” and “income.” In normal times, sure, they sit there and throw off a coupon, and everyone feels great... But corporate bonds live in an awkward middle ground when things go sideways. They’re not as safe as Treasuries, and they don’t offer the upside of stocks. When stress hits, you often get the worst of both worlds. Investment-grade bonds are a bet on survival. You’re betting the company stays alive and pays you back. High-yield bonds are a bet on confidence. You’re betting the market keeps believing in these companies and that credit spreads stay calm. Guess what disappears first when liquidity tightens? Confidence. When I look at corporate bonds, I want shorter maturities because they give the company less time to screw things up… You have to be really good outside investment-grade (I recommend you follow Tim Melvin on this when we’re late in the liquidity cycle). You should want companies with more cash than near-term debt, businesses that don’t need to refinance constantly just to keep the lights on. The red flags are pretty obvious once you know what to look for. Long-duration bonds issued when rates were near zero are trouble waiting to happen. All of this has to be refinanced. That wall is coming. There’s no magic allocation number for corporate bonds. But if you can’t explain exactly why a bond belongs in your portfolio when things get ugly, it probably doesn’t. 3. “When in doubt, throw it out.” Does that apply to portfolios?Yes. And more than most people want to admit. The positions you “sort of understand,” the ones you keep meaning to look at, the stuff that’s been sitting there since 2019 that you forgot about. Those are almost always the positions that blow up worst during drawdowns. You don’t have conviction, which means you don’t have a plan, which means you’re going to make a terrible decision at the worst possible moment. If you can’t explain why you own something today, not why you bought it, but why it deserves your money right now, you have a problem. If you don’t know who might be forced to sell it when conditions get rough, you have a problem. If you can’t name the assumptions that have to stay true for the thing to work, you have a problem. Throwing it out isn’t panic. It’s honesty. 4. How much cash should be held for opportunities in a retirement account?This is the question everyone wants a number for, and I’m going to disappoint you. Cash isn’t a fixed percentage. I don’t have an answer… Cash is a function of how much opportunity is out there and how much risk you’re facing. In calm markets, cash feels like dead weight. In stressed markets, cash is a weapon. For a lot of investors right now, somewhere between 10% and 30% in cash (really money markets) isn’t nuts. That’s not a bearish call or a prediction that the world is ending. It’s just recognition that optionality matters more than precision when things get weird. Cash lowers your emotional volatility. When you know you have reserves, you don’t panic when prices drop. Cash gives you speed. When real opportunities show up, you can actually do something about them instead of watching from the sidelines because everything is already deployed. Cash lets you buy when prices disconnect from reality, when the forced sellers are puking up good assets at stupid prices. People consistently underestimate how valuable it is to be able to act when others can’t. This matters even more in retirement accounts. If you’re pulling income from your portfolio, you never want to be in a position where you have to sell stocks during a crash just to pay your bills. You need to familiarize yourself with the term “Sequence of Returns Risk.” The goal is to stay liquid, stay flexible, and stay solvent long enough to still be standing when the market finishes doing whatever it’s doing. You don’t need to predict the storm. The five questions from last week weren’t meant to scare you. They were meant to give you a process. I hope you’re building one. And when you’re ready, use it. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment