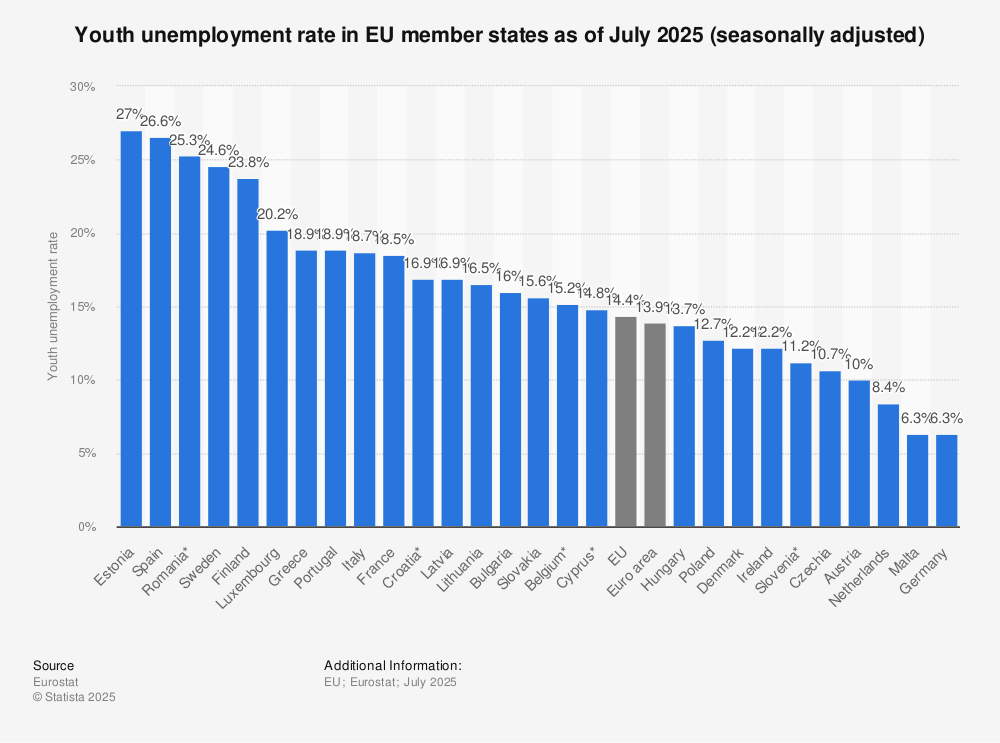

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. So, I Think I'll Start With Europe...I spent a lot of time in 2025 on Japan... now I turn my attention to where an obvious crisis will emerge...Dear Fellow Traveler: There’s a chart floating around that looks harmless until you realize what you’re looking at. It’s the kind of chart that gets passed around policy conferences with coffee stains on it. Financial experts nod at it gravely, and then immediately ignore it in favor of whatever acronym is trending this quarter. It shows youth unemployment across Europe, including both eurozone and non-eurozone countries. Even outside the eurozone, European labor markets experience the same cross-border capital cycles and dollar funding matters. At first glance, it’s the same story as where we were back during the 2011 European Banking Crisis. Southern Europe is struggling. Northern Europe is holding it together… And those statistics, known as the “EU” or Euro area” average,” smooth over the problem… and the chart goes away… because who cares about the Romanians? (Oh… that’s right… the EU canceled the Romanian Presidential elections in 2025…) Go back far enough and central banking usually causes our problems… To me, unemployment in Europe is not purely a labor market story. It is a story about capital… or the lack of it… and about incentives. It tells you what happens when business capital stops committing to the future. If this sort of malaise in Europe keeps up, the European project may remain politically intact while becoming economically hollowed out by the end of this decade… And that’s when the real problems start… if they haven’t already… Turning My AttentionI spent part of 2025 focused on Japan because it shows how far the global liquidity system can bend without breaking. I still think Japan is a huge problem… But I can’t ignore Europe anymore, because Europe tells you where the stress exists. The ghosts of the 2011 European Crisis never left. Anyone who lived through 2011 knows how this goes. For reasons I still don’t comprehend, it’s like Europe only has five central bankers… all changing seats at any given moment. Christine Lagarde is still in charge there, still calling for reforms after more than a decade of influence that produced exactly the conditions now requiring reform. We know Japan for being that pressure value for decades. It had yield curve control, weak currency tolerance, strong capital outflows, and chronic dollar borrowing. All the things we know fiscal repression can fuel… Japan shows you how long the system can run at high temperatures (decades). Europe will show us what happens when all that capital cools (in just months). The mechanics of 2011 have not changed. Europe still has a shared currency that I’m not convinced anyone really wants, except maybe the central-banking public servants getting paid tax-free salaries and lots of stipends with virtually no accountability… (it’s good to be the king). They have fragmented fiscal systems across 27 nations, but all run on the same monetary policy that can’t create the reserve asset their system actually needs. Oh… and what is perhaps the most important thing that people don’t really know… Europe has banks that fund globally but lend locally, and reduce cross-border exposure first when funding risk rises. Europe doesn’t fail because it’s weak. It fails because it’s short dollars at the wrong moments... Dollar dependence varies across Europe, but the stress always shows up first in the economies most reliant on cross-border capital, not the ones most insulated from it. The fundamental issue is that youth unemployment is not evenly distributed across the EU. Germany sits at 6.3%. Spain sits at 26.6%. That is a four-to-one ratio inside the same monetary union, under the same central bank, at the same policy rate. You could make excuses… call the Germans industrial and the Spanish lazy… but those narratives do not hold… Demographics and education matter on the margin. However, those two things can’t explain why highly competent states like Sweden and Finland have unemployment rates comparable to crisis-era Greece. Capital mobility is the ticket... Sweden, a country with strong institutions and a reputation for competent governance, has a youth unemployment rate of 24.6%. That’s the 12th freest economy in the world… unable to provide economic freedom to its youth. Finland is at 23.8%. They’re 13th in the Heritage Economic Freedom Index and have shockingly strong fiscal health. And yet, they're building a lost generation too… Greece, the perennial crisis case (83rd ranking), is actually lower than both at 18.9%. This figure, though, reflects years of outward migration and labor force contraction instead of renewed confidence. The EU average of 14.8% tells you nothing useful when the spread between top and bottom is over 20 points. The average hides the problem, so no one has to address what’s fundamentally wrong. The problem isn’t nationalism, education, talent, effort, or demographics. Labor protections and hiring rigidities matter, but they amplify the cycle rather than drive it. It’s capital access and confidence… It’s where money will only go when liquidity tightens and where it quietly refuses to follow… and those failures happen really fast and then remain a problem. It’s Not The Same in EuropeEurope doesn’t absorb economic stress the way the United States does. The U.S. absorbs stress differently because it prints the reserve currency and attracts global capital. We adjust through layoffs, call it ‘flexibility,’ and keep going. In Europe, they call layoffs unthinkable and quietly stop hiring anyone new. The system protects incumbents and sacrifices the future… constantly. Youth unemployment is not a lagging indicator in Europe. It’s an early warning of what’s coming when the capital flows narrow… likely in the next two to three years. Hiring a 22-year-old is a long-term bet, but those bets disappear fast when funding gets expensive. When liquidity is abundant, even weaker regions get capital. When liquidity turns, capital becomes selective, defensive, and domestic. When capital gets nervous, it stops thinking in decades and starts thinking in hours. The euro solved the exchange rate problem, but outsourced the funding problem. This is what many American readers might not actually understand… And where the risk lies. Where the Stress Will BuildThe eurozone runs on euros, but European finance still runs on U.S. dollars. That gap is the issue. Their banks clear trades, clear commodities, and margin derivatives in… the greenback. They fund shipping, energy, and global trade in dollars. Europe doesn’t create those dollars. They borrow from U.S. money markets, FX swaps, repo, prime brokerage, and wholesale channels that exist outside the European Central Bank’s control. As long as dollars are abundant, this system looks stable. When dollars tighten, funding costs rise, balance sheets tighten, and cross-border lending can freeze fast. Everything retreats and shows up quickly in trade finance, lines of credit, and yes… youth hiring. We get caught up, however, in GDP figures… and other things disconnected from what actually moves these markets: Access to Capital… and the ability to refinance whatever we’re refinancing. GDP can be a huge reflection of government spending… which puts more strain on the state and reduces actual private investment and growth. If you want to know whether capital believes in the future of a nation or region, ask whether it’s willing to train someone who hasn’t been useful yet. They’ve Been WarnedPhilip Lane is the Chief Economist of the European Central Bank. He has warned that euro area banks could come under pressure if U.S. dollar funding were to dry up, noting that dollar exposures and volatile funding conditions could limit lending to the real economy during periods of stress. It happened in 2008. It happened in 2022. It’s going to happen again… When dollar funding becomes scarce, European financial institutions don’t panic first. They conserve capital and lend closer to home. And the first thing that gets cut is investment in people who represent future growth rather than current cash flow. Which is why youth unemployment rises long before sovereign spreads explode or banks make headlines. So what happens when stress returns? This is where the Federal Reserve enters the story, whether it wants to or not. When the Fed opens dollar swap lines with the European Central Bank, it’s not bailing out Europe in a political or social sense. It’s lending dollars to a central bank against euros for a fixed term at a “penalty rate.” These swap lines are temporary and conditional… But here’s the thing… they’re necessary, and we’ve repeatedly seen the Fed activate or expand swap lines during periods of global stress, often well before domestic fiscal responses arrive for the American people. That’s because Europe’s sneeze can turn into America’s banking flu. Happened in 2008… happened in 2020… It will happen again… The swaps are designed to calm markets, not fund growth. They’re a liquidity bridge for refinancing… not a capital solution… this is just more exacerbating the problem… a lack of quality collateral and a constant need for dollars. Yes, China is extending its own swap lines with Europe, but recent Venezuela developments are a wildcard. China had long-term oil claims there… the U.S. is now asserting its own interests. If global traders are forced to choose sides, supply chains could split, Western firms could lose yuan access, and European banks would need even more dollars. That’s stress stacked on stress. And the stress really lies in this issue… We are refinancing global debt… and doing so at a level that crowds out real risk-taking and investment in growth. None of these actions (swap lines etc…) forces banks to lend. None of this really repairs confidence. They prevent fire… not produce oxygen. The Federal Reserve controls whether swap lines exist, how large they are, and when to use them. The ECB can print euros all day. That doesn’t make a single dollar appear. Which is what makes all of the “de-dollarization” movement so interesting. Any new reserve currency - if it is to replace the dollar - will need to replace that plumbing too. Who wants that responsibility? Europe would have to run permanent trade deficits to do this… And China is currently holding a record trade surplus. They probably don’t want that responsibility either… because the reserve currency creates a resource curse. What Comes Next to EuropeIf the next episode of stress arrives, it will not look like 2011 headlines. There will be no dramatic announcement or “save the euro” speeches. It’ll look like a quiet expansion of swap line usage, broader and even newer forms of collateral acceptance, more frequent rollovers, and the possibility of new standing facilities dressed up as coordination. We might get a cool new acronym to throw around to lie to ourselves… And Christine Lagarde will still be there, while the policy framework Draghi built continues to define the system. The Fed (whoever is leading it next) will frame it as market functioning, global stability, and technical operations… as they do with everything else... Europe will frame it as cooperation… Markets will understand it as dollar scarcity, balance-sheet stress, and duration tightening. It will probably mark the bottom of the next crisis… but it won’t solve the same structural problems that have persisted since the EU’s inception… Banks will respond the same way they always do. They’ll take even less risk than they already do, hire fewer people, and stare into the world wondering what the future looks like for a banker… a young banker…. This is where the current global liquidity cycle matters. At the top of the cycle, capital flows freely across borders, and risk looks manageable everywhere. But as the cycles roll over… that money stops being European... It flows to Germany before Spain. It goes to the Netherlands before Italy. It’ll rotate to the national balance sheet strength before political promises. The European Central Bank can cut rates and buy bonds. But it can’t… and never has been able to force private capital to commit across borders when funding risk rises, and confidence falls. That is how a financial problem becomes a social one… and then a political one. High youth unemployment suppresses long-term growth, increases fiscal burdens, and accelerates brain drain toward the core nations or out of Europe entirely. That feeds into weaker growth expectations, a heavier reliance on the public sector, and greater pressure on national balance sheets. The loop is slow, and the system stops investing in its own future at the margin, and the costs compound over time. Something needs to be done… When you see charts about youth unemployment in Europe, don’t read them as a story about jobs. Read them as a story about liquidity, capital confidence, and cross-border flows already tightening beneath the surface. I’m not changing subjects from Japan to Europe. I’m following the same machine to its weakest seam. Japan shows you how long the system can run at high temperatures. Europe shows you what happens when it cools. And the Fed sits at the center of both, whether it wants to or not. The clock is ticking… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment