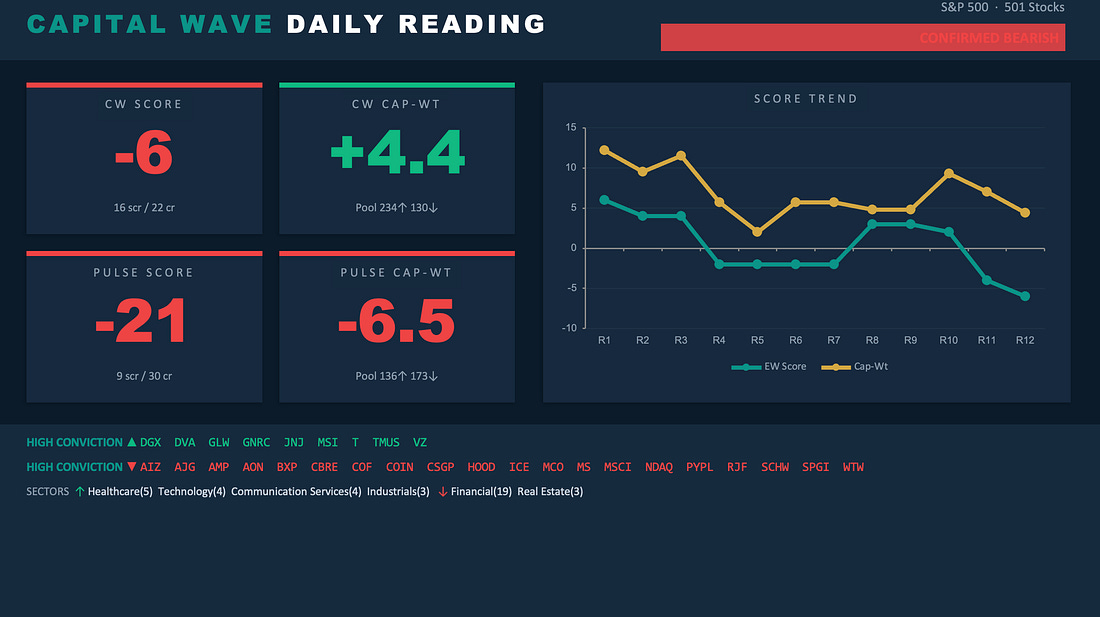

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: This is a weird time to be an economist. It’s a weirder time to be a human being. I’ve been chatting with you about the impact of AI on the economy. We’ve discussed how consumers are paying for the AI infrastructure… all while watching their electricity costs go up… up… up… Goldman Sachs noted that electricity prices increased by 6.9% in 2025. That was double headline inflation of 2.9%. Meanwhile, Microsoft’s CEO basically just admitted that AI will continue to take jobs in the future… So… let me do the back-of-the-envelope analysis here. Our jobs are at stake… but we’re paying double to power the machine that is going to take our job. Someone better start explaining the benefits to the American people fast. This is the equivalent of giving your paycheck to the person you are training to replace you. And it can’t be the people who own the AI companies to do it… Otherwise… we’re going to end up in a very bizarre place politically and spiritually… The Bright SideNow, let me say something outside the box before we wrap up this note. I’m an AI optimist. Two words… Target audience. I’ve been in on ChatGPT since Day One. I learned to code. I found ways to boost productivity. But since markets are where my head and heart is… I’ve been able to build and amplify my Momentum System on its back… I have been able to crack an impossible mathematical equation that took me six years… and now bring it down to a visual representation of all the weighted stocks. I’m not kidding. SIX YEARS. I was doing all this stuff by hand (via excel since COVID.) If I can do that… you can do something positive. You just have to figure out what it is. Meanwhile, there’s been a lot of chatter about the Fourth Turning… And how are we in this hypernegative period? Well… each Turning is 20 years, and the Fourth one started in 2008… if you prescribe to that way of thinking… Well… guess what… widespread AI adoption might be the start of the First Turning… an opportunity for a different way of thinking and approach. And while you might say… “Garrett, you’re being too optimistic…” Let me respond to that. Should I spend my day stressing over something I can’t control… or just find the bright side and find a way to control the things I can? My health, my wealth, and myself. As I said yesterday, focus on scarce and productive assets. There will be a lot of casualties in the AI world. This is the same playbook as what happened to Retail Stocks in the Dot-Com era… a Retail-Apocalypse… now morphing into real estate and other things that will become outdated fast… Go through the Five stages of Grief as you must… I’m at acceptance… And I’ll be waiting to help on the other side. With wealth, we have that covered with our Momentum Signal… The world will be very different in 24 to 36 months. Take your time. Process it. I hope it’s better than it is today… and I’ll stay glass half full in the process. Someone has to… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment