You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Fight to Save a Bank... Somewhere...SOFR tells us that there's a crunch happening... so too does policy in Japan.When our S&P 500 signal is red (as it is now), we urge heavy caution in these markets. As we note below, a major accounting change in Japan could provide some support to the financial plumbing in the system, while we wait for markets to react to the latest inflation report and SIGNIFICANT options expiration in February. Be on alert for squeezes today… and some greater activity… I’ll have the momentum numbers and everything we’re watching on the live stream this morning. Click here to join us at 8:45. Capital Wave Report, Friday, February 20, 2026Good morning, The Secured Overnight Funding Rate (SOFR) has been trading above the Fed Funds rate again... Which explains why the Fed is quietly shoved another $30 billion into repo before anyone could ask questions… When we asked questions, we saw that Japan just changed mark-to-market rules for its financial companies holding underwater government bonds… That’s not a coincidence. That’s a confession. I want to remind everyone that - as we watch the markets bounce around, and the Direxion Daily Financial Bear 3x Shares (FAZ) continue to rally higher… The Fed doesn’t set the price of credit. Markets and balance sheets do. Cash scarcity really does. The Fed can propose a rate, but the system decides whether it’s believable. The Fed could cut rates to 0% tomorrow, but the market will look at the long-term inflation outlook and laugh. Interest rates aren’t commandments. They’re just prices, and prices only hold when supply and demand agree to cooperate. When the SOFR moves above the Fed Funds rate, the market is saying it doesn’t care about the target range because cash is tight… Repo is secured lending, so it should trade at a lower rate than unsecured fed funds. When it doesn’t, something upstream is broken… That something is dollar scarcity colliding with Treasury issuance and bank balance-sheet constraints at once. Hence… the moves on banks and the ongoing challenges we’re seeing elsewhere - largely private credit and private equity. I keep telling you that we’re in a financial crisis, and no one wants to act like it. The support is unprecedented for the financial system. One thing people don’t understand is that the price of money isn’t set in Washington. It’s set globally, in FX markets, in cross-currency basis swaps, in offshore dollar demand, and in collateral chains that never show up in a CPI basket. The dollar is a traded asset, and when the world needs it, it tightens whether Powell wants it to or not. So while policymakers talk about “restrictive policy,” the market is repricing credit risk in real time. That’s what SOFR is telling you. The Fed can lean against it, but it cannot overrule it. That $30 billion repo injection didn’t make headlines because it’s now framed as “ordinary maintenance.” That phrase should scare you more than a surprise rate hike. Emergency tools aren’t an emergency anymore. They’re baseline operations in a system that cannot tolerate friction. That repo wasn’t about inflation control. It was about preventing overnight funding from seizing up, which is the Fed admitting, through action rather than speeches… Administered rates are drifting away from market reality. When that happens, the Fed doesn’t lecture the market. It supplies cash and hopes nobody notices. But here we are… again… And we’re debating whether PCE came in one-tenth hot. Inflation prints tell you what already happened. Repo tells you where the stress is right now. One is a weather report from last week. The other is the pressure gauge on the boiler. Pay attention… there’s a cash crunch happening right now… and central banks are pulling a lot of levers to stop a Silicon Valley Bank-level crisis here and abroad… Traders FocusQuiet start for a Friday. It’s the monthly options expiration, so everything has something expiring today. Plenty to trade if you’re looking. VIX is sitting right in the middle of its range, which is fitting since we get PCE this morning, and things could go either way. FNGD is still painfully high. We’re opening right at the 8-day moving average... That’s a little bit of relief. Need to see more follow-through there. FAZ is the other one to watch now. The inverse financials ETF added 3.5% yesterday and is back to levels we haven’t seen since November. That was the last crack in the system before Japan turned around and started printing again. We need to see both of these breaking back down under their key moving averages. As long as they’re elevated, everything stays a little sketchy. Financials are the real weakness right now. The whole group looks bad. Blue Owl is causing problems again, and everybody’s getting beaten up, as evident in the shadow banks... Private credit stress is showing. That all said… It’s a monthly expiration for February in options markets (and that means squeeze potential. All those beaten-down names become candidates. Names like… The alternative asset space. The software names that got hammered. There’s a lot of stuff out there that might find some bids today. That doesn’t mean you rush out and buy it all. It means you pick a couple of names, put them on your watchlist, stalk them, and wait for the opportunity. If you’re looking for entries, keep it simple. Watch the 8-day moving average crossing the 20. Or cleaner still, just watch the MACD on a 3- or 5-minute candle. Trade at the beginning of the cross, get out when it breaks back down. Another reminder for you… Japan quietly changed accounting rules for its life insurers this week. Bonds held to maturity against long-term liabilities can now be classified as held to maturity and exempt from impairment accounting even if prices fall. This is similar to our Bank Term Funding Program. This was a major catalyst for a U.S. rebound back in March 2023. The big insurers were sitting on trillions in unrealized losses and being forced to sell. This removes that pressure and keeps the funding channel open. The first mover was expected to be metals, and we’re seeing that this morning. Silver is back over 80. Gold is at 5,050. Platinum and palladiumare both up 2 percent. Now we’ll see if it spills into equities. We continue to focus on what’s working this month. Energy. Utilities. Consumer defensives. Industrials. Basic materials. Everything else has been spotty. Stay there to avoid unnecessary headwinds. Market outlook

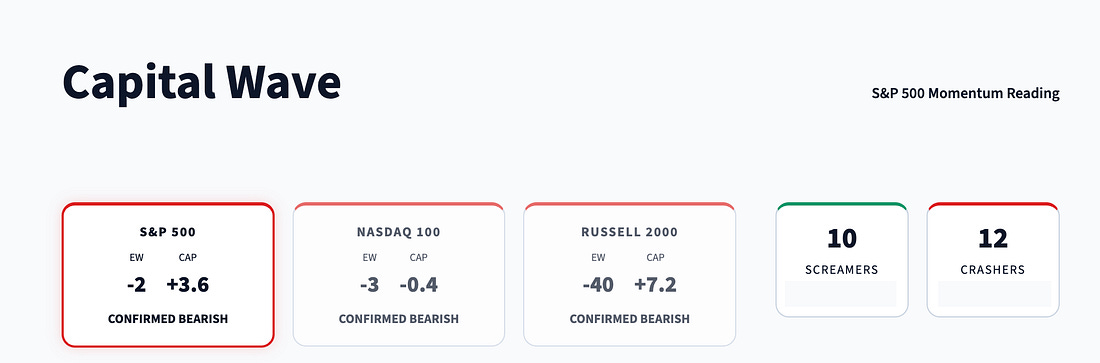

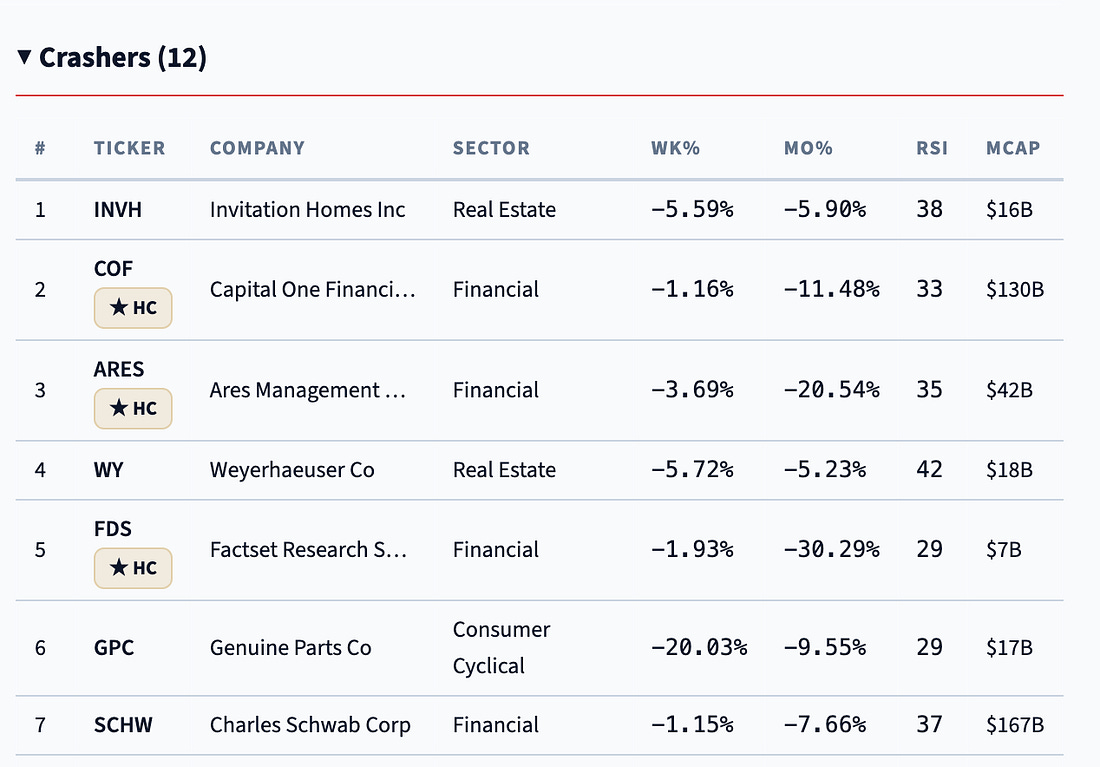

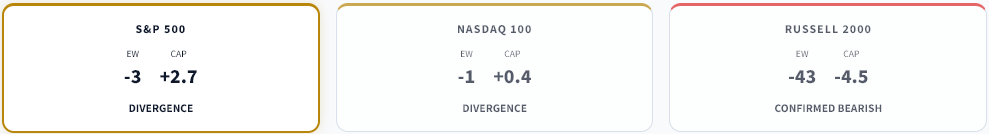

Momentum - Slight Improvement Thursday gave back the gains from earlier in the week. The S&P slipped a quarter percent, the Nasdaq fell about the same, and the Dow dropped over half a percent, with financials leading the way down. Our readings have improved slightly this morning, with the S&P at -3, the Nasdaq at -1, and both showing positive cap-weighted numbers. The Russell remains confirmed bearish. We’re marginally better off than yesterday, but not enough to change the broader picture yet. The real concern right now is financials. This isn’t just a soft patch. The big private equity and private credit names are under real pressure. The FAZ, the inverse financial ETF, hit levels we haven’t seen since November, and that was the last time we saw a policy response to stabilize things. Strain in the financial plumbing tends to show up here first, and right now it’s showing up. Energy remains the only sector with positive momentum on our readings. Deere had a monster day, up 16%, and a handful of breakout names like TPL and J&J are still running, but these are pockets of strength in a market that’s broadly negative. We’ve now been in negative territory on our readings since late January, with no significant change in direction. Walmart’s weak guidance on Thursday didn’t help the mood. NVIDIA earnings next week will be the next big test. For now, this is still a market where you want to be very careful about what you’re reaching for. Insider Buying: Light Day - Boring

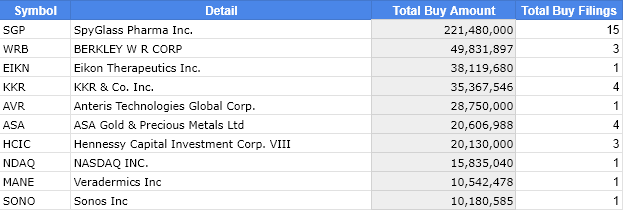

Top Insider Buys of Last 10 Days - Form 4 Documents Market Liquidity PCE hits this morning, and it’s the number the Fed cares about most. Consensus is looking for core to come in around 2.6%, down from 2.8%. That would keep the disinflation story alive, but after the hawkish tone in the minutes earlier this week, even a friendly print may not be enough to get the committee moving anytime soon. The dollar is on pace for its best week since October, trading near 98. Oil pushed above $71 on the Iran situation. Gold just crossed $5,000. Financial conditions, according to the Chicago Fed, are flat, not loosening, and that’s showing up in the plumbing. The Fed moved $30 billion through the repo window yesterday, and we’re still weeks away from when tax season really starts pulling cash out of the system. The place to watch right now is private credit. Apollo, KKR, Blackstone, Blue Owl, all of them are under real pressure this week. That’s where leverage lives, and historically, that’s where the cracks show up first. If the stress keeps building, the conversation shifts pretty quickly from rate cuts to something bigger. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment