Was Google's 100-Year Bond a Sign? Dear Reader,

You might have missed this headline amidst all the market noise, but Google’s parent company Alphabet (GOOGL) just issued 100-year bonds to cover the cost of its AI infrastructure buildout.

One hundred years…

Stop and think about that for a minute. A hundred years ago, we were right in the middle of the “Roaring 20s.” This was the decade that saw a lot of New York’s iconic Art Deco architecture take shape. Like today, it was a time of rapid technological adoption. Radio, mass electrification, “talking” motion pictures, automobiles and more advancements were available for the masses… It was an exciting time to be alive.

But how many companies from that era are still around today… or even shells of their former selves?

Coca-Cola (KO), Procter & Gamble (PG), Colgate-Palmolive (CL), PepsiCo (PEP), ExxonMobil (XOM) and a handful of others were around back then and are still alive and kicking today. But none of these are what you would think of as a “tech company.”

The tech darlings of the 1920s – think General Electric (GE) and IBM (IBM) – don’t look so hot today. General Electric was broken up back in 2024, and its spare parts now trade as GE Vernova (GEV), GE Healthcare (GEHC) and GE Aerospace (GE). And IBM is a dinosaur that was left behind by the cloud computing revolution. It’s not exactly relevant in today’s tech world.

Will Google still be relevant in 100 years?

None of us will be here to find out… unless tech has made us all immortal by then. Still, it’s safe to say that the data centers they are building today with their cash won’t be. IT hardware has a shelf life of three to five years at best.

Alphabet is a fantastic company, and it’s emerging as the leader in AI implementation. It also happens to be a holding in my Infinite Momentum Tech Titans portfolio. I bought GOOGL shares a little over a year ago, and they’re up more than 60%.

But I can’t help but think that years from now, we’re going to look back at the century bond as a high-water mark of tech hubris.

At any rate, our trading horizon at Money & Markets is significantly shorter than 100 years. I build trading strategies with horizons ranging from a few days to a few years. I’ll leave the multidecade trades to others.

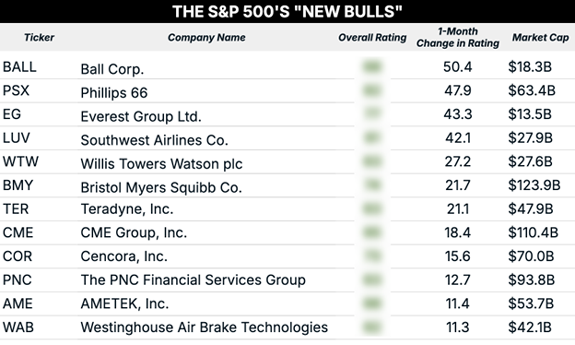

Speaking of systems, let’s see what companies have recently popped up as “Bullish” on my Green Zone Power Ratings system, starting with the newly “Bullish” members of the S&P 500. | Whitney Tilson, the hedge fund veteran 60 Minutes called during the '08 crash, just unveiled a new AI strategy that ranks 6,000+ stocks. One unexpected name just scored near-perfect, and he's revealing the ticker for today's wild market. Click here. | S&P 500 New Bulls One trend has been abundantly clear all year. “Old economy” stocks are leading in 2026 while most tech stocks are struggling. Ironically, fear of AI disruption is the biggest driver of that underperformance, as software companies have especially taken a beating this month.

Investors are reacting by flocking to stodgy old companies that are effectively AI proof. I’ll highlight a few that caught my eye.  At the top of the list this week is Ball Corp (BALL), which is about as old-economy of a company as you can get. Ball is the world's largest manufacturer of recyclable aluminum packaging and the leading global producer of aluminum cans – used for beer, soft drinks, energy drinks, and sparkling water. Its shares have been marching higher since November.

Energy stocks have performed well this year, so it’s no surprise to see refiner Phillips 66 (PSX) newly rating as “Bullish.” The shares have been moving higher all year.

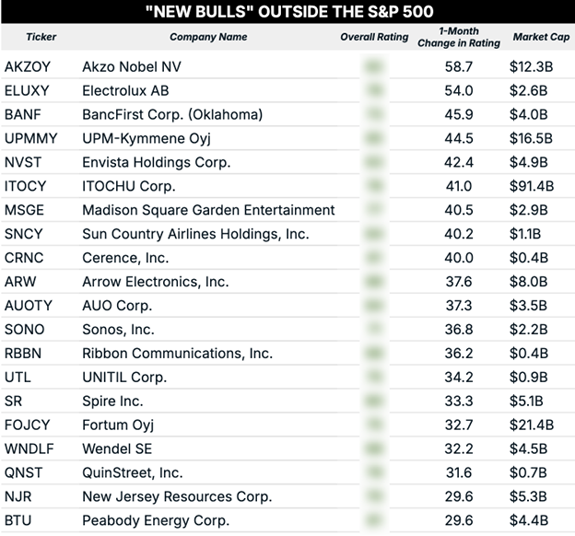

Interestingly, Southwest Airlines (LUV) made the cut this week as well. Southwest has struggled in recent years as inflation has crimped the budgets of cost-conscious American travelers, underperforming more premium rivals like United Airlines (UAL) and Delta Air Lines (DAL). But the shares have been trending sharply higher since November, and they rate particularly strongly on their growth and momentum factors at 87 and 86, respectively. New Bulls Outside the S&P 500 Let’s cast the net a little wider and look at the newly “Bullish” stocks outside of the S&P 500 Index. I ran a screen for the top 20 stocks that saw the greatest jump in their score over the past month.  We see a recurring theme here. The company with the biggest jump in rating over the past month is Dutch paint company Akzo Nobel (AKZOY), followed by appliance maker Electrolux (ELUXY).

One name that caught my eye was Madison Square Garden Entertainment (MSGE), which owns the namesake Madison Square Garden – home to the NBA’s New York Knicks and NHL’s New York Rangers. It also owns Radio City Music Hall and a handful of other iconic entertainment properties.

In a world where AI is destroying the competitive moats of established businesses, scarcity is key. Prime entertainment real estate is – by its nature – rare. If you want to watch professional basketball or a major concert in New York City, you’re doing it at Madison Square Garden. It has no real competition, and AI can’t render its business obsolete.

A company like this has limits to growth, of course. There are only so many events you can book in a given year. But in a world where virtually everything is fragile and easily disrupted, prime entertainment real estate should remain a stable store of value.

To good investing,

Adam O'Dell

Editor, What My System Says Today

|

This is a critical and time-sensitive message.

It’s regarding Starlink, which is expected to be the largest IPO in history – set to take place in as little as a few weeks.

And for the first time ever, we’ve found a way for you to profit BEFORE the IPO happens.

One of the world’s top venture capitalists and Silicon Valley insiders has just released all of the details… including a prospectus… in this short message.

Click here now to discover how to take action BEFORE the IPO on March 26th. | |

Post a Comment

Post a Comment