You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. What "Risk" Means During Earnings SeasonWe went Yellow for a hot minute... and turned right back around...Editor’s Note: We’ve been “Red” since last week (with a small poke to Yellow at the end of the day on Monday, before today’s selloff. Still playing the rules of negative momentum, and still out of the way since last Monday’s warning.)

Yesterday, we had some fun at Wall Street’s expense. Today, we get serious. A lot of people ask me about stocks. What do I like? What should they buy? What’s the next big winner? I understand why they ask. But that’s not really what I do. I’m a risk person. My job... and what I try to teach here... isn’t about finding the next highflier. It’s about helping you limit downside so you can sleep at night. And then applying those lessons to situations with real upside, especially if we get a regime shift at the Fed and a change in broader liquidity over the next two years. That’s the game I’m playing. So when earnings season rolls around, I’m not hunting for “beats” or chasing guidance raises. (A Post-Drift Momentum strategy I’ll use after earnings is a different conversation for a different time.) I’m looking at something different… especially in negative conditions. Who can survive on a day like today? Balance Sheet SurvivalOn the micro side, I still believe fundamentals work. I don’t trash them… I think they’ve told a reasonable amount of the story on the way up, but not as significant as the ongoing liquidity support since late 2022. In this environment, it’s not about growth rates or TAM slides or “the story.” It’s about one thing: Can this company survive a liquidity contraction? Can it handle the stress of everyone running for the same pile of cash to refinance existing debt like it’s the last Costco rotisserie chicken before a snowstorm? These are serious questions… and they’re going to matter over the next 18 months. With a risk-based focus, everything else is noise until you answer them. I’m not going to bore you with equations. Here’s what I look at and where to find it. 1. Net Cash and Maturity WallsWait what? This is easy. Who has net cash on the balance sheet? And who is sitting on a pile of maturities coming due in 2025, 2026, and 2027? Who can refinance easily, and who is lying to themselves about capital access? This isn’t about private credit or governments. This is about basic measurements that you can use to understand what the hell is going on with a company’s debt. If they were borrowing at under 2% a few years ago, and now they have to refinance it all at over 6%, that’s a huge problem. When money was really cheap, nobody cared about maturity walls. When money was free, maturity walls looked like speed bumps. Now they’re guardrails missing on a mountain road. A pretty standard way to determine what problems they face is just to look at a few measurements. You can go to Finviz. Then, pull up any ticker. Under the Financial tab, look at…

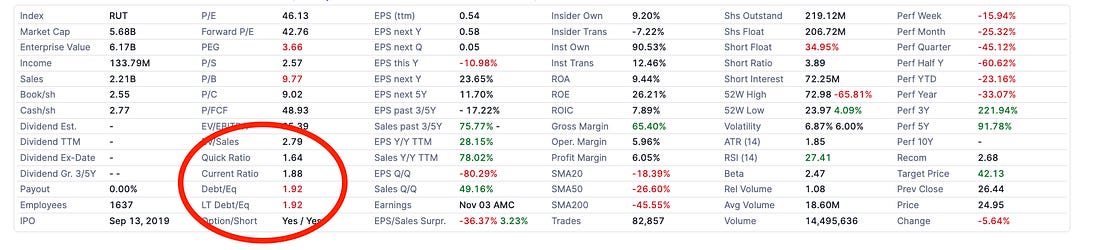

This is the financial sheet of Hims (HIMS)… the online pharmaceutical company. Those four metrics are right there… Red is no good. Now… if you’re a glutton for punishment, you can check when each specific debt will mature. You need to pull up the 10-K, parse through the debt footnotes, or the Contractual Obligations table. But for a quick read on balance sheet health, Finviz gets to the basics in 10 seconds. Companies with clean balance sheets and no near-term refinancing risk can play offense. Everyone else is hoping the Fed bails them out before the bill comes due. 2. Free Cash Flow DurabilityMargins are great. But margins won’t pay a company’s bills. They need cash. I don’t mean cash that’s sitting in the bank right now. I mean that they’re prepared and versatile when the time comes. I want to see businesses that can self-fund in a tightening environment. We aren’t going with companies that need to tap the debt markets every 18 months to keep the lights on. Where to find it: Uncle Stock and GuruFocus has the Piotroski F-Score built in. That’s a 9-point scale measuring financial strength. Higher is better. It combines profitability, leverage, and operating efficiency into a single number. I also pay attention to the Altman Z-Score for bankruptcy risk and the Beneish M-Score for earnings manipulation. GuruFocus and other sites calculate these for you. If the M-Score is flashing, it doesn’t mean fraud. It means someone is getting very creative with a spreadsheet and a late-night vodka. 3. Insider BuyingThis is one of the few signals that hasn’t been arbitraged away. When insiders buy, especially cluster buying during periods of stress or drawdowns, it means something. These are people with real information, putting real money on the line. I’m always interested in seeing big buys by executives after they report earnings. Where to find it: You need to go to EDGAR and find direct purchases… You don’t want to be parsing through 10% ownership and indirect buys. We do this daily right here. Insiders collectively tend to call bottoms. Not because they’re geniuses. Because they hate losing their own money. It’s not perfect, but it’s collectively better than most. 4. Simple Valuation, Anchored to Enterprise ValueI’ve learned to distrust story-driven multiples. When liquidity is abundant, stories get bid up. “It’s not about earnings, it’s about optionality.” Or… “You’re paying for the platform.” Sure. Until liquidity fades. Then stories get repriced. Brutally. Where to find it: Finviz shows EV/EBITDA right on the quote page. I prefer EV/EBIT when I can get it, but EV/EBITDA is close enough for a quick screen. Combine that with a high F-Score, and you’ve got something interesting. Quality and value in the same place. Here’s Tim Melvin… if you’re looking for more. That’s where momentum can ignite when a trend finally arrives. What I’ve AbandonedI don’t care about P/E when liquidity is the oxygen. A cheap stock without financing is just a slow suffocation. And I’ve mostly given up on traditional cycle indicators. The ones that assume we’re operating in a “normal” monetary environment. The ones built on historical patterns from decades when the Fed wasn’t the largest actor in every market. We don’t have a normal environment. We have a managed system with periodic stress fractures. We’ve been living in one for the last four months. So I’ve stopped trying to predict cycles the old way. Find the companies with the balance sheets to endure. Watch where insiders are putting their own money. Look for quality at reasonable valuations. And stay alert to regime shifts in monetary policy that can change everything. The people who get this right in the next two years will do very well. The people chasing “beats” and “raised guidance” will wonder what happened. If that sounds boring compared to chasing “AI optionality,” good. Boring is how you survive. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment