- Despite an economy in disarray, industrial automation remains strong.

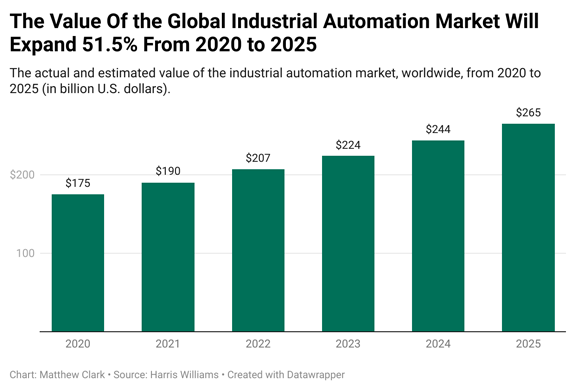

- The industrial automation market will expand 51.4% from 2020 to 2025.

- Today’s Power Stock brings automation to the factory floor, and it rates a 93 on our proprietary system.

| Remember watching videos of early assembly lines at Ford Motor Company?

A small team of people would rush around a car as they worked to carefully lower the engine block into the chassis of a car.

Now, one person uses a keypad to tell a robot to do the exact same task with laser precision.

Go to any major auto manufacturer and that is exactly what you’ll see.

Factories of all sizes are adopting automation at a rapid pace — despite the global economy teetering on recession.

And the industrial automation market is expanding at a solid clip around the world:  (Click here to view larger image.) Global investment bank Harris Williams forecasts the size of the industrial automation market will hit $265 billion by 2025. That’s a 51.5% jump in just five years!

These are the kinds of mega trends that spark my interest for the Stock Power Daily.

And I know that our Stock Power Ratings system will help me find companies set to benefit from this massive market growth.

Click here or the button below to reveal the ticker of one stock that fits the bill for 2023.

| From our Partners at Oxford Club. Tech monsters like Apple, Amazon, Microsoft and many more can no longer avoid doing business with this one company that trades for less than $5...

All of them are held "hostage" by the "Patent King" CEO's brilliant business tactics.

And what's even crazier...

Is that his tactics reach all the way to the public.

He intentionally set up his company's stock under a secret trade name...

Did he fool you too?

Click here to see more. |

The Housing Market Is Broken Data on new home sales will be released later this week.

Some potential homebuyers are hopeful that prices will fall — last month’s report showed the median sales price dropped 2.8% from its all-time high.

But new homes are still out of reach for most buyers with median sales for November 2022 sitting at $471,200.

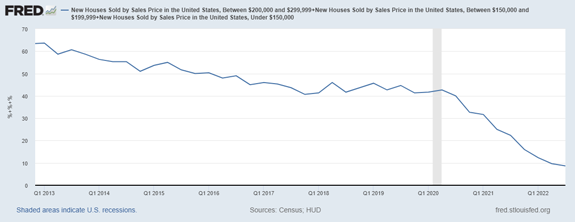

The chart below shows that just 10% of new homes are priced below $300,000.

And less than 1,000 homes priced below $200,000 were built in the past year. Before the pandemic, about 40% of new homes were at this price point.

Builders have abandoned the entry-level home. Sellers are also demanding a return on their investment which means once-affordable homes are now selling at a premium.

Bottom line: The housing market is strong for families that can afford the median home and unavailable to an increasingly large group of families.  (Click here to view larger image.)

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment