Editor’s Note: Mike Carr jumped at the opportunity to explore what’s going on with Silicon Valley Bank and what it means for the broader market. Be sure to check it out further down in this email.

- Oil and gas transportation is still a hot industry to invest in as demand remains elevated.

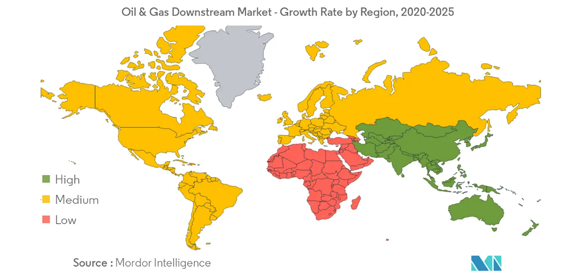

- The fastest-growing oil and gas downstream market is the Asia-Pacific region.

- Today’s 95-rated Power Stock operates a strong downstream oil and gas network from the Pacific Northwest to the Hawaiian Islands.

|  | One of my wife’s good friends lives in Hawaii.

Beautiful place to live and visit…

But I can’t say the same about the cost of goods and services.

AAA reports the average price of a gallon of gas in Hawaii is $4.85. That’s 42% higher than the national average of $3.41.

Ouch.

The reason: Getting goods to the island is not an easy venture. Just about everything has to be shipped in, and that’s expensive.

It’s why, in Hawaii, one of the most important industries is the oil and gas downstream sector.

This includes companies that refine, deliver and sell gasoline … the last step of the oil and gas supply chain.

Mordor Intelligence reports that the fastest-growing oil and gas downstream market is the Asia-Pacific region, including Hawaii:  (Click here to view larger image.) As you can see from this graphic, the region expects high downstream market growth due in large part to increased demand in countries such as China and India.

Today’s Power Stock operates refineries and an extensive transportation system, including trucks, rails and barges, to move oil and gas through the Asia-Pacific and Pacific Northwest regions as well as Hawaii.

Click here to reveal its ticker.

| From our Partners at Banyan Hill Publishing. Tech stocks got murdered in 2022. But the financial conditions that slaughtered them aren’t going away.

The Fed has made it clear interest rates will stay higher for longer, meaning these companies won’t see the cheap debt they need to fund their operations for years.

This is one of the most obvious outcomes in the market that no one is talking about. And Mike Carr wants to tell you how to profit from the situation as these stocks head further south.

Get the full details from him here. |

Ernest Hemingway is known as a great author, but he’s also an expert financial analyst.

In his novel The Sun Also Rises, he explained how Silicon Valley Bank (SVB) failed.

One character asks another: “How did you go bankrupt?"

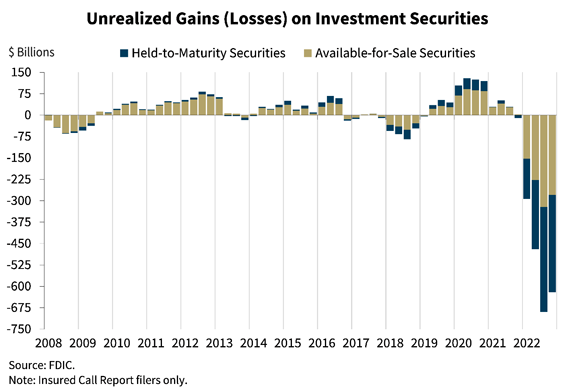

The answer describes the bank’s downfall: “Two ways. Gradually, then suddenly.” The Gradual: Easy Money Flowed In SVB’s failure started in 2009 when the Federal Reserve dropped interest rates to historic lows.

It accelerated in 2021 as low interest rates made it easy for the bank’s tech startup clients to raise money. They held that money in SVB’s coffers because they didn’t need it.

But SVB needed to put that money somewhere.

Managers decided to lock up billions of dollars in long-term bonds, the same bonds that will fall the most if rates rise. Banks have sophisticated risk models, and SVB’s models must have said: “buy.”

To see why the sudden collapse in the chart below happened (and what’s next) click here.

(Click here to view larger image.)

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment