| Matt’s Note: Mere hours from now, Mike Carr is opening the doors to his latest and perhaps greatest trading strategy: the 9:46 Rule.

He’s pulled out all the stops this week to prove to you that short-term trading is not just a useful moneymaking tool … it’s essential to the market environment we’re in today.

And what’s really mind-blowing? It’s always been useful. Yes, even during the boom times when stocks went nowhere but up and buy-and-hold value investors were dancing in the streets.

Today, Mike exposes a hidden secret of these types of investors — they care about price more than they care to admit.

Read on to learn how, by following Mike’s ideas, you could’ve front-run none other than Warren Buffett … but not before you secure your spot at Mike’s presentation this afternoon.

The Big Lie of Value Investing Outside looking in, value investors look like they have it pretty easy.

Companies issue new financial statements every three months. They shouldn’t need to do anything between those releases.

Yet … there’s more work at hand.

Valuation metrics change every day. The price-to-earnings (P/E) ratio, price-to-sales ratio or dividend yield (the dividend-to-price ratio) changes every day.

Obviously, it’s the price that drives the change. Still, they claim price action isn’t important.

That’s the domain of technical analysis. And as Warren Buffett supposedly said: "I realized that technical analysis didn't work when I turned the chart upside down and didn't get a different answer."

Buffett is a smart man. But he’s wrong here.

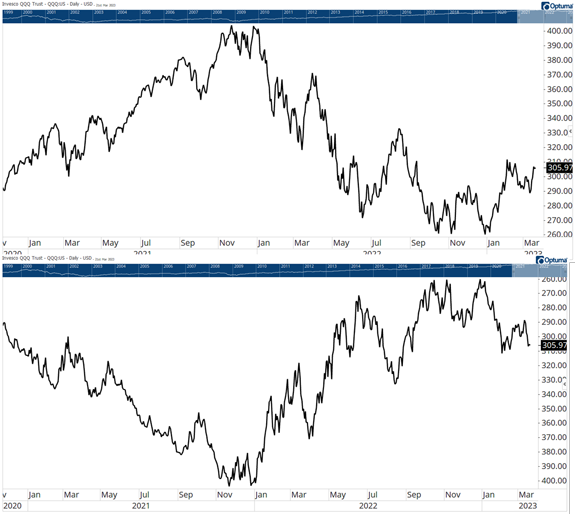

Look at the two charts below. Which one is giving you the correct answer about how to invest?  (Click here to view larger image.) The one on top shows a downtrend. The one on the bottom shows an uptrend.

Both are charts of the Invesco QQQ Trust (Nasdaq: QQQ), which tracks the Nasdaq. So you don’t need me to tell which chart is correct.

If you act like Buffett and decide to follow the bottom chart anyway, you’d be buying into a downtrend. That’s never a good idea.

Clearly, Buffett is wrong here. Price does matter. That’s why he and other value investors look at it so much.

Value investors are actually focused more on the P than the E in the P/E ratio. They like to say they analyze the business. But ultimately, they always trade based on price.

That makes sense. If their analysis shows the business is worth $20 a share, they wouldn’t buy it at $20. They would want to buy lower.

In the end, they aren’t really buying businesses. They’re buying shares of stock. And this is where an analysis of the price action is most important.

| From our Partners at Banyan Hill Publishing Most traders focus on the open and close of the markets … and they completely breeze over what happens every day at 9:46 a.m. Join Chartered Market Technician, Mike Carr today at 1 p.m. ET as he reveals what happens at this time … and how you could profit.

Register to attend here for FREE. |

Front-Running Buffett Let’s say you found a business worth $20 a share. The stock is at $6. You have the chance to make 233% if you’re right.

For this discussion, we’ll assume you’re right. This is a massively undervalued stock.

The problem is the stock might stay undervalued. There’s no guarantee that enough investors will agree with you and buy the stock to make it go up.

That’s why so many stock pickers give interviews to CNBC. They need other people to buy.

Stocks only move up when other people buy it. Stock prices fall when sellers act with a sense of urgency. If no one buys or sells the stock, it doesn’t move.

That’s not a problem for Buffett. Because when he announces a new buy, other investors buy.

Buffett’s track record leads others to assume he knows something they don’t. The chart of Louisiana-Pacific Corporation (NYSE: LPX) is a good example.

Buffett’s company Berkshire Hathaway (NYSE: BRK.A) announced its position in November 2022. We know he was buying in the weeks before that announcement because regulations require the timely disclosure of actions by large investors.  (Click here to view larger image.) At the bottom of that chart is an indicator I designed to identify the buying and selling of large investors. It began rising in September 2022 and dipped right before Buffett’s announcement.

In hindsight, we knew the indicator was rising because Buffett was buying.

This chart shows the real problem with technical analysis. It takes skill to analyze charts. It requires indicators that aren’t widely available. Often, it requires indicators that you have to build yourself.

We can’t follow Buffett’s moves with moving averages, MACD or other tools available for free on dozens of websites.

But we can follow them if we dive deeper — to a level most value investors don’t even know exists.

We look at several different tools in my trade room every morning that have proven to work well. Among them, of course, is my “9:46 Rule.”

I’ve been developing this new system with my subscribers for the past several months, placing trades with my own money, and the results have been more than promising.

Fifteen minutes after each day’s opening bell, we get the data we need to put together a trade with the potential for 50% gains in no more than two hours.

And this is just one of seven different strategies I use every day with my subscribers.

Later on today, I’m opening the trade room to new participants — an opportunity which doesn’t come around often.

To make sure you’re one of them, go here and put your name down to attend this afternoon’s webinar.

I have one more piece lined up for my big takeover of the Stock Power Daily.

Tomorrow, I’m going to tell you why you shouldn’t worry about what a company does. It all boils down to the underlying stock.

Speak to you then,

Michael Carr

Senior Technical Analyst, Precision Profits

| From our Partners at Banyan Hill Publishing. A looming financial event that one expert calls the “Middle-Class Massacre” will soon devastate millions of hardworking Americans.

When it strikes, and all his research proves it will strike in 2023, he predicts stocks will crash 50% ... real estate will be slashed in half ... unemployment will surge to record highs ... and the wealth of millions will be decimated as the biggest bubble in history bursts.

Go here for the full story… |

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment