| With the stock market, as with life, not all things are created equal.

Deep … I know.

But let me explain.

Last week, our managing editor, Chad, dove into travel and tourism stocks in his weekly essay. If you missed that piece, check it out here.

I was intrigued by O’Reilly Auto Parts Inc. (Nasdaq: ORLY). Not because it was a bad stock (quite the contrary, according to our Green Zone Power Ratings system).

And in inflationary times, I expect stocks like ORLY to do well. That’s because interest rates are high and banks are tightening lending — meaning it is harder to get a basic car loan.

In lieu of purchasing a new car, many decide to maintain the vehicle they have … meaning big business for aftermarket car part dealers like O’Reilly.

That got me thinking about the industry as a whole…

So I looked at the broader car part market through the lens of our proprietary ratings system, and what I found is that not all stocks are equal.

Here’s what I mean… The Rising Tide Doesn’t Lift All Ships Since the Federal Reserve started hiking interest rates to combat high inflation, stocks related to the car part market have boomed.

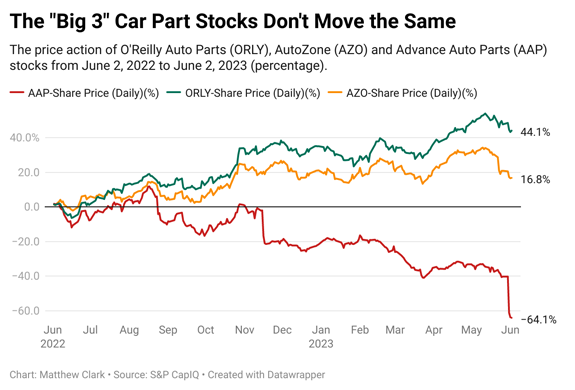

But not every stock:  (Click here to view larger image.) For comparison, I tracked the one-year price movement for ORLY, AutoZone Inc. (NYSE: AZO) and Advance Auto Parts Inc. (NYSE: AAP) … what I would consider the “Big 3” in the sector.

As you can see, ORLY (green line) and AZO (yellow line) have moved almost in lockstep. ORLY is up about 44% over the last 12 months while AZO is up about 16%.

In and of itself, that shows a pretty strong market considering the S&P 500 is only up about 1% over the same time.

However, look at AAP (the red line). That is a massive drop in a single year.

In case you missed it: AAP sank 35% last week alone after cutting its full-year guidance and quarterly dividend amid weak earnings.

But the stock was declining even before its massive earnings miss.

What Green Zone Power Ratings Says About AAP This is where things get interesting.

As a self-proclaimed data nerd, I like to look at a range of things related to stocks … not just price.

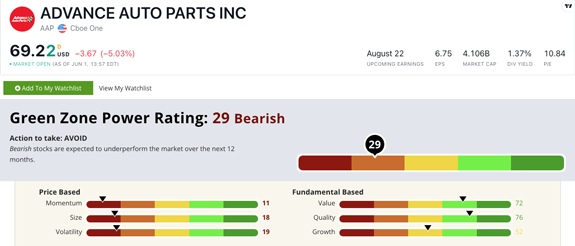

Here’s where the Green Zone Power Ratings system comes in handy:  (Click here to view larger image.) Just as you would suspect after looking at that stock chart, AAP rates a “Bearish” 29 out of 100 on our proprietary system. This means you should avoid the stock as we expect it to underperform the broader market over the next year.

Considering its performance of late, that isn’t surprising.

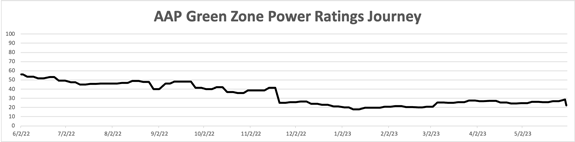

But here’s what is:  (Click here to view larger image.) This is the history of AAP’s ratings on our system over the last year.

Never has the stock rated above a “Neutral.” In fact, when the stock reached its 52-week high of $203.41 in August 2022, the stock was rated a 40 out of 100. That tells us to sit on the sidelines and wait for a potential uptrend in momentum.

That uptrend never happened and the stock continued to push downward … along with its ratings.

Bottom line: The point here is that our system gives you an additional tool in your belt to use besides just price action.

Using our Green Zone Power Ratings system would have kept you away from AAP stock and saved you from a 66% loss — the drop from its 52-week high to my last view of the price.

And this kind of analysis pays off because, as I mentioned earlier, the other two big players in the car parts game are doing remarkably well.

That might lead you to think that others in the sector are doing equally well.

But, as the ratings system and stock performance tell us … not all things are equal.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment