Editor's Note: A “Money Code” options trade Adam recommended to his Max Profit Alert subscribers on Monday (four days ago) … netted them a 165% gain in just 48 hours. If you want to know how to gain access before Adam sends his next trade recommendation on Monday at 2 p.m. ET., click here. |

Money & Markets Daily,

It's been a wild earnings season.

Every time I've pulled up Bloomberg recently, another company is posting a big earnings beat — and the stock price is soaring higher in response.

It can stir up feelings of FOMO (fear of missing out).

But I won't dwell on big stock price moves that weren't in my portfolio. (META's 20% single-day move, in particular, stings for me.)

Instead, I want to show you how we can use Green Zone Power Ratings in a couple of different ways as it relates to earnings.

But first, let's see how our system and quarterly calls interact…

Green Zone Power Ratings and Earnings

When Adam O'Dell designed Green Zone Power Ratings, he didn't base the entire model around quarterly earnings reports.

It is a complex system that considers dozens of variables and boils those down to six simple factors and an overall rating that is easy to digest.

This is also a long buy-and-hold indicator. We're looking at projections for a stock for the next 12 months. While an earnings report may spark a short-term move, Green Zone Power Ratings tells you if that bullish (or bearish) price action should continue from here.

But we can still use the system to our advantage because we can do two things:

- See if a recent price rally is sustainable for a specific stock.

- See how a stock rates before it reports — to either avoid a potential crash or get in before the next earnings beat.

Let's start with a company that just reported earlier this week…

| From our Partners at Banyan Hill Publishing. After a series of banking collapses hit mainstream media, the surge in bitcoin's (BTC) price has raised eyebrows. In fact, many are recognizing BTC as one solution with its 70% growth rate seen so far this year; yet another crypto could have much more potential and disrupt global finance within our lifetime! With investment already pouring in from PayPal and Square plus Mark Cuban and billionaires Elon Musk and Ray Dalio on board too ... there may be serious opportunities out there today if you know where to look — learn how you can get started with only $20 here now before it's too late! |

NCLH Posts 17% Gain — What's Next

Earlier this week, Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) reported its first profitable year since 2019.

That makes sense. Remember, COVID-19 obliterated the cruise line industry. I can recall chowing down on nachos at our company retreat in February 2020 and talking to my team about cruise stocks. They were sinking fast (pun intended) as reports of the pandemic's spread came out.

Three weeks later, we were all working from home, and NCLH had lost 85% of its value from its January 2020 peak.

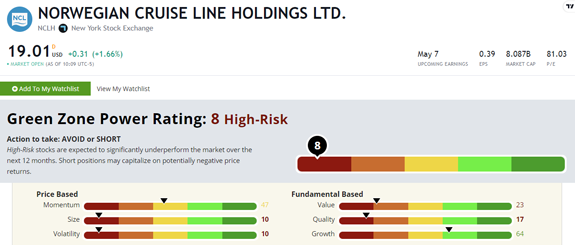

And while NCLH's bullish earnings report triggered an 18% gain between Monday's close and Wednesday's high, Green Zone Power Ratings isn't high on this stock:

Norwegian Cruise Line stock rates a "High-Risk" 8 out of 100 in our system. Stocks in this category are set to significantly underperform the broader S&P 500 over the next 12 months.

That rating could improve as investors look for bullish opportunities in downtrodden sectors, but there are some big red flags here.

The stock rates a 23 on Value. Even after a massive crash, the stock still trades at an 81 price-to-earnings ratio.

NCLH is also still massive, with a market cap north of $8 billion. That's why it rates a 10 on Size.

Its Volatility rating also puts it in the top 10% of most volatile stocks that our system rates.

While the pop after earnings this week was a good sign, I'd instead stick to stocks that are much more stable.

Let's explore using Green Zone Power Ratings as an earnings preview now.

Discount Retailer Looks Strong

I always love a good deal.

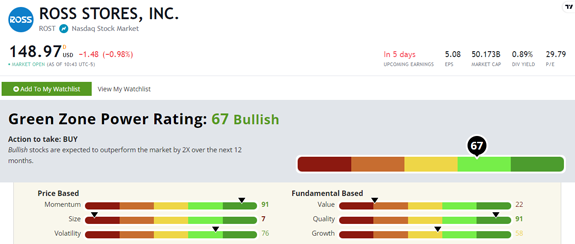

And going off the Green Zone Power Ratings for Ross Store's Inc. (NYSE: ROST), I'm not alone:

I'll repeat this until I'm blue in the face: This is why I love Green Zone Power Ratings!

ROST was nowhere on my radar. We can be so focused on innovation and glitzy tech stocks that "Bullish" (and boring) stocks like Ross fly by unnoticed.

With a 67 out of 100 rating, ROST is set to 2X the broader market over the next year.

It has steadily gained 34% over the last year, which is why it rates a 91 on Momentum and a 76 on Volatility.

A 91 rating on Quality is also fantastic! That tells me the company has a strong balance sheet and that it's not burning through cash to keep the business afloat.

ROST reports earnings on Tuesday, March 5. And while we can't predict what executives will report (Wall Street analysts expect earnings per share of $1.65 on average), Green Zone Power Ratings points to this stock outperforming over the long run anyways.

Bottom line: Our system isn't built to predict big post-earnings swings, but you can still use it to your advantage during wild earnings seasons like this one.

Just go to www.MoneyandMarkets.com and type a ticker into the search bar.

Within moments, you'll have a better understanding of that stock's prospects from here…

Until next time,

Chad Stone

Managing Editor, Money & Markets Daily

Sentiment Still Glum Despite Low Unemployment

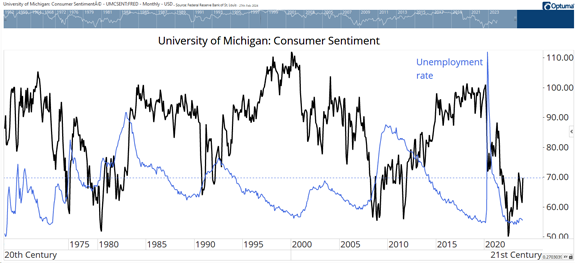

The latest reading of consumer sentiment shows apprehension. Economists believe sentiment should be high when unemployment is low and inflation is falling, as the data says it is now. However, sentiment remains at levels seen only at times of high unemployment in the past. You can see that in the chart below.

We can’t explain the reason for the disconnect with economic theory. Consumers understand interest rates are high, which makes it tough to buy a home or finance a house. Rather than focusing on what economists think is important, consumers are realizing that they can't afford large purchases.

Sentiment could change quickly if the Federal Reserve cuts rates later this year. At that point, consumer stocks — including beaten-down appliance makers like Whirlpool (NYSE: WHR) — could soar.

— Mike Carr, Chief Market Technician, Money & Markets

(Click here to view larger image.)

Check Out More From Money & Markets Daily:

Post a Comment

Post a Comment