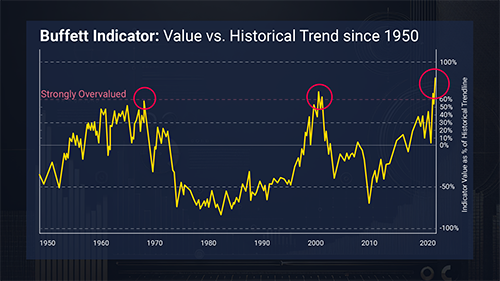

| This one chart Warren Buffett has called: “Probably the best single measure of where valuations stand at any given moment.” It’s not the Fed rate… earnings… or some moving average or RSI squiggle… It’s a chart so simple, so powerful, Buffett has used it to make his biggest moves - including when he walked away from the markets entirely in the late ‘60s.  It's known as the "Buffett Indicator." And it just hit 217% - its highest level ever in financial history. Translation: stocks are more overvalued now than before the dot-com crash… the 2008 meltdown… and yes, more overvalued than even 1929. So it’s no mystery why Buffett is sitting on a $382 billion cash pile. Now he’s hunting for the only asset able to protect his wealth as the next phase unfolds. And I know what it is. Buffett is likely about to buy gold - but not just the metal… He’s about to buy a massive stake in one specific gold miner that posted one of their strongest quarters ever. Producing $1.7 billion in cash flow, and over 1.5 million ounces of gold in Q2 alone. The company also announced plans to buy back $3 billion worth of stock, and it will maintain its $0.25/share dividend, which will return a total of $1 billion to shareholders by the end of 2025. I believe his position will show up in his November 15 13F filing. And if I’m right… There will be a stampede of retail investors trying to follow him in. That’s why I’ve put together a special gold intelligence dossier - revealing: - The exact miner I believe Buffett is targeting right now…

- Four smaller miners with 100X upside potential thanks to what I call “The Golden Anomaly”...

- A special bonus pick about to ramp up to full production… selling at an 83% discount to fair value… and led by a CEO whose last project turned $18 million into $1.2 billion for shareholders…

earn which company Buffett is likely to buy - and get details on my top four picks for the coming gold mania. Garrett Goggin, CFA, CMT

Chief Analyst and Founder, Golden Portfolio P.S. **NOTE: The Buffett Indicator has never been wrong. Every time it flashes, gold outperforms. And this time, the gains could be truly historic. |

Post a Comment

Post a Comment