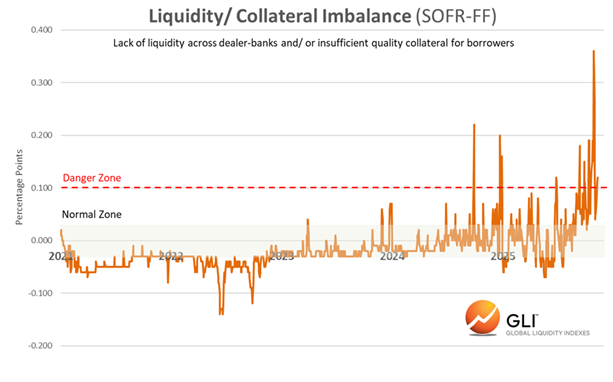

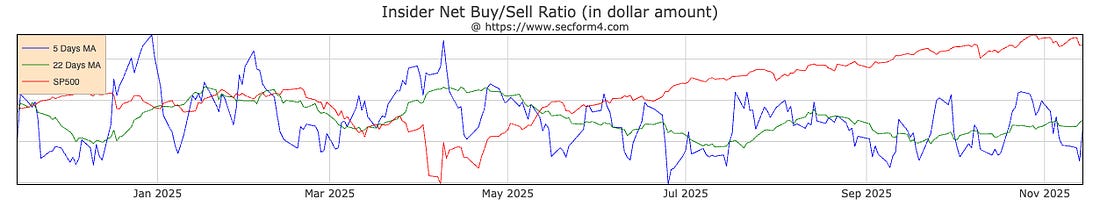

Everyone Now and Expert on Repo Markets (They're A Month Late)This morning we talk about capital efficiency... why everyone's now a liquidity expert... and more.Good morning: In September, I was on TheoTrade, after the Fed meeting… and I issued a pretty clear warning. “I’m worried about what starts to happen when the repo drains and the SOFR starts going above the Fed Funds rate again…” It was quiet for a bit… no one really wanted to talk much about the repo market. But I was explicitly warning about the likely strain on the financial system… I didn’t know it would take two months to get here… but now here we are in Red momentum. Thing is… when everyone is acting like this… with a lot of fear over something that a lot of people are Googling… then it could be a contrarian Bottom environment… The strain between collateralized lending and uncollateralized lending is flashing some serious red flags (well… orange ones in this CrossBorder Capital chart)… Our momentum signal turned negative twice on the S&P 500 last week. But the Russell 2000 equation has run negative largely since late October. The ongoing strain in capital markets isn’t “just like 2019.” It’s just like every year since 2019. For some reason, a lot of market “experts” haven’t put two and two together that the nonstop monetary and fiscal expansion has hit speed bumps. We’ve seen lots of strain and deleveraging from COVID to the GILT Crisis, from Silicon Valley Bank to the Liberation Day… from the Nikkei Crash in August 2024 to the largest hedge fund selloff in 15 years in June 2022. We’re too accustomed to multiple-sigma events hitting us… And no one is doing the autopsies… Our current strain is the result of cratering banking reserves. It’s a sneak preview of the looming challenges ahead as we face massive refinancing over the next 36 months. The Fed will likely resort to Quantitative Easing at some point… they will call it something different… But we are in a very difficult environment. And as I noted, it’s never good when the New York Fed calls an emergency meeting with banks to encourage them to borrow all they want from the Standing Repo Facility. Because… as I’ve noted… the SRF is going to be tested… which is what makes the next two weeks so… interesting… Given that the central bank is pulling out all the stops… I’ll be watching the insider buying-to-selling ratio to get a sense of whether/when it’s time to really lean back in… What To Do Right NowOkay. So, as I noted, my focus is now on the Federal Reserve. It doesn’t appear ready to cut rates again in December. Concerns about inflation remain elevated, and the bigger problems are clearly in the financial plumbing. I don’t know what the policy response will be either from the Fed or the Treasury Department… but I do know that I have my ear to the ground - and I’m watching aggregate insider buying to selling. As I’ve pointed out since the inception of my research in 2020, the insiders have collectively called the bottom of every major crash, panic, mania, and even blip dating back to the 2008 Financial Crisis. Why does this matter? Because they’re likely piped into D.C. better than most people on any pending policies. Likely… sorry… ARE. S&P 500 companies spend a lot on that sort of consulting… Now then… I hope that we navigate this period of uncertainty with some basic instructions on identifying the best stocks to buy if this market does go on sale. As I noted the other day, however, we have to account for the significant shift in market participants since the 2008 Financial Crisis. The world has changed immensely in the 1990s when passive investment flows were minimal and the traditional “Value investor” dominated the landscape. As CrossBorder Capital noted last week, the “value arbitrage” investor has gone from about 80% of the market flows to less than 25% in 30 years. What’s largely replaced this market has been passive investment flows (ETFs) at more than 50%, and leveraged funds that are continuing to dominate momentum flows through repo leverage. So… my solution last week was for investors to target stocks that appeal to the overall appetite of all three asset allocators. Given that value arbitrage investors are now a smaller part of market flows, I would argue it is best to identify the equities they would want to buy that would attract the interest of the bigger fish. Which is what I’m going to tell you about right now. ... Continue reading this post for free in the Substack app |

Home

› Uncategorized

Post a Comment

Post a Comment