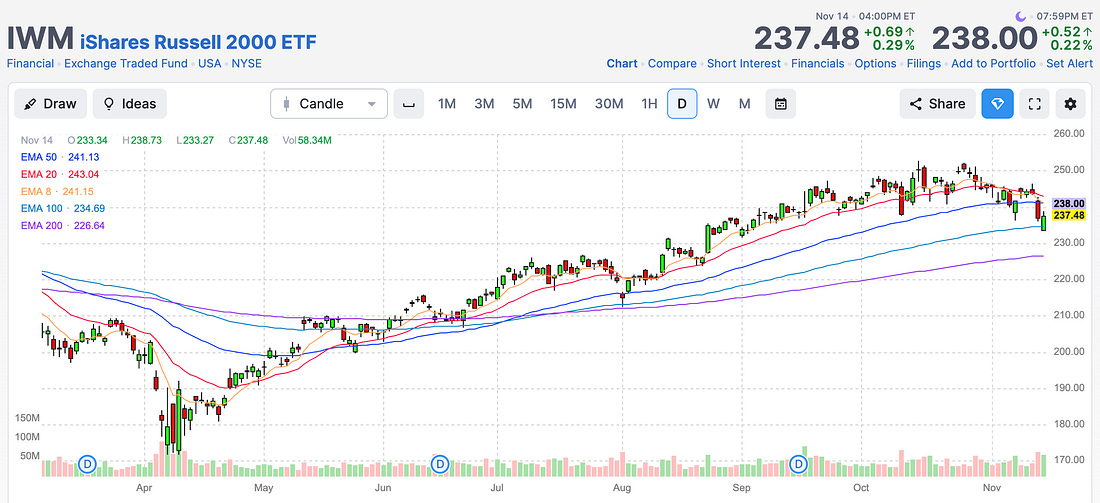

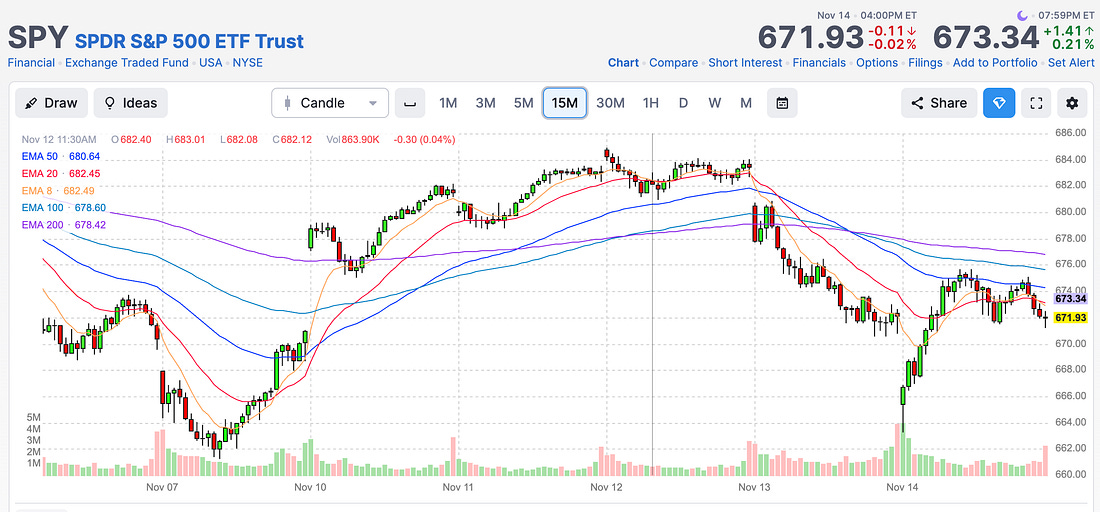

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Postcards from the Edge of the World...It's a quiet Sunday that will take me many places... Here are some reflections... The Week in Review... and the Week Ahead...Dear Fellow Traveler: For those who don’t know… this publication began as something called Postcards from the Florida Republic. I was living on the outskirts of the barrier islands in Southwestern Florida, far away from my editorial team in Maryland. I’d spend hours on air… but none of the marketers were watching… always asking what Garrett was saying about the markets… So… I started writing this on the weekends… it was 15 pages of charts and other ideas. When I sent it to the marketers… they still never read it. Frustrated again, I started to send it to publishers each week. It caught attention… After time, I was recruited to Baltimore to launch this concept with a company… After 18 months, we never got the resources to do it… So here we are again… but growing. I had to sell my farm to move here… it was called The Florida Republic. Well, here we are today… in the middle of Central Maryland… It’s windy. But backed onto two acres of liveable land, supported by ample forest and water. I have called this farm “The Edge of the World.” Postcards from the Florida Republic gave way to Me and the Money Printer - after a well-timed report we wrote called The Hedge of Tomorrow in March 2024, when we recommended gold at $2,100, silver at $25, and Bitcoin at $62,000. The realization was that markets were not operating on fundamentals, but instead on a constant source of refinancing and a never-ending commitment by politicians and policymakers to sacrifice the productive parts of our economy to rent-seekers and leveraged funds. Our equity focus here centers on liquidity, momentum, and insider buying, combined with how that feeds into the optimal long-term stocks to own… In fact, the Capital Wave Report (the paid subscription that goes with Me and the Money Printer) will dive into all of the metrics this week that will help you identify the best stocks supported by this market’s ecosystem. I will conclude this week with a list of names that become long-term, must-own stocks. But Postcards from the Florida Republic has always been a part of my personality… I had to change the name because I no longer lived in Florida. But more importantly, I didn’t have a “home.” I didn’t have a place where my identity aligned with the soil. I didn’t want to perform. Faking an identity impacts your integrity… and when both are negatively affected by pretending to be something that isn’t real… it has no impact. It doesn’t deserve your attention if I’m still writing Postcards from the Florida Republic, but I’m not writing and reflecting from under that same coconut tree… Do you understand? That’s just performance… It would just be an act… So… here we are now…in the shade of the timberline. So, I’ve found “The Edge of the World” farm… A place where lawn meets forest… where light fights shadow… where open ground leads to mysterious drop-off… In the next few weeks, I’ll be re-launching Postcards from the Edge of the World every week… It will operate at my Personal Substack… and it will return to its roots - long weekly analysis that contains plenty of charts, opinions, and more… It will also be a good time to revisit old friends… and showcase the evolution of our thinking… There are snapshots and postcards from times that require revisiting… And old friends… Look for the first one to arrive in December… after Thanksgiving with Tim Melvin… You can sign up for free… right here… We will then begin discussing that site as the necessary support system for our growing fascination and focus on optimal investments in the extraction game. And as always, if anyone is interested in syndicating or partnering, please reach out… Chart of the WeekThe Russell 2000 has been negative according to our Momentum Reading since late October. But Friday, we saw a rebound that got a lot of people excited… Well, it turns out that the Russell 2000 bounced off its 100-day moving average, setting up some technical support. The question now is whether we have reached the worst of this short panic or whether we’re setting ourselves up for more challenges due to liquidity strain. Michael Howell suggests Monday is setting up to be a very important day… What’s Happening Right Now?We’ll keep this simple… Since July, I’ve talked about the Repo markets and concerns about the state of liquidity and reserves in the system to the point of exhaustion. The ongoing selling at Softbank in Japan… the weakness in banking reserves… the Fed’s overnight Standing Repo Facility activity… and much more. Look - this stuff is intentionally vague… The average American has no idea what I’m talking about. Half the copywriters and publishers I speak with look at me like I’m talking about nuclear physics. The reality is simple. It’s intentionally vague so that people don’t ask a ton of questions. They want their homes and their cheap mortgages and their auto loan… but they don’t want to know how people keep their hands on the scales to ensure that all of that U.S. debt gets bought and suppressed to prevent a blowout… I’m not defending Wall Street. I’m just reminding you that without all the financial engineering in the post-2008 world, things can get really fair, really fast… Well, now we know that the Fed is doing what it can to maintain stability… Last week, they had an unannounced meeting with banks in New York City to encourage them to keep borrowing from the Fed. Just get access as you need it… The alarms are going off… and Bitcoin’s continued decline underscores real stress on liquidity (capital) in the system and the ability to refinance debt. The ongoing strain suggests that banks are facing capital shortages… Tomorrow appears to be critical because they convened the meeting so quickly and so hastily. One can assume that if anything cracked, they’ve been hanging out all weekend at the New York Fed, stress-testing everything… But I will show you something that matters. Here is your weekly S&P 500 SPDR ETF… There is no such thing as a coincidence in these markets. We cracked into red on our reading on Nov 7, squeezed for two days, and then turned right back around and started cracking lower red again on Thursday morning. We bottomed out against the massive technical support on Friday morning, then turned around and squeezed higher into the day, finishing with some selling… The fact that we gapped down didn’t matter. What mattered is that the momentum readings - the number of stocks breaking down versus breaking out… actually got WORSE during the day. More stocks moved into breakdown mode on both the Russell and the S&P 500… even while the markets were short-term squeezing. This isn’t unusual for a market that’s under stress. Algorithms and technical traders capitalize on this all the time… The real problem is what happens when you zoom out… Another break under the 100-day moving average could take us down a lot more… I was hoping that we’d get clarity on the government reopening and optimism on what the Fed and the Treasury would be doing. But for now… we keep reacting and staying in the corner with our Red Signal that flashed before Thursday’s drawdown. Expect more volatility and more chop in the coming weeks and months… In Case You Missed It November 10: On Incentives... and Gambling Scandals... November 11: Seven Minute Abs and the Laziness of a 50 Year Mortgage November 12: Why Michael Burry Walked Away... November 13: What to Trade With a Little More Confidence November 14: Buffett’s Alphabet Stake Fits the “Every Buyer” Portfolio Strategy November 15: Dollar Store Conspiracy Theories Remember… Tomorrow, we kick off a five-day focus in our Capital Wave Report on identifying the businesses that align with the various investors that flood the markets with capital. By the end of the week, you’ll be able to find them yourselves… but we’ll also have a nice rolling About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment