Editor’s Note: We’re launching a new e-letter from Tim Sykes this week. It’s completely free and packed with a ton of great trading insights. If you want to receive this email, simply click here now to sign up.

New Bulls in a Market

Looking for Direction Dear Reader,

The S&P 500 today is exactly where it was in the last week of October. All of the churn over the past six weeks has been sound and fury, signifying nothing.

Really, this is a market in search of direction.

And you get it…

The economy – and corporate earnings – remain strong. But take away AI capital spending, and the U.S. would technically be in recession. AI really is propping up not only the stock market but the entire U.S. economy.

Is that sustainable?

It’s possible, but there are also risks mounting.

AI really is revolutionary technology, and we’re in the early stages of a major productivity boom that could neuter inflation and massively boost wages.

But then, news broke yesterday that Morgan Stanley was in discussions to offload a good piece of its data center exposure in order to reduce risk. So clearly, someone isn’t entirely convinced it’ll be only smooth sailing from here.

So, what happens next?

Does the AI bubble deflate… or does it get a second wind?

Will the Fed cut rates next week… and will it be enough to keep Wall Street happy?

You probably know by now that I don’t spend a lot of time forecasting precise answers to these kinds of questions.

Instead, I follow the data. | Bloomberg just leaked details of a secret project Steve Jobs set in motion before his death. After more than a decade under wraps, Apple is finally preparing to unleash this breakthrough — one that could reshape a $9 trillion industry overnight. Click for full details. | I use my Green Zone Power Ratings system to objectively rate stocks based on measurable metrics related to their momentum, volatility, size, value, growth and quality. I ignore the noise and only invest in the best of the best.

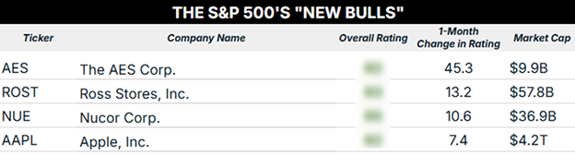

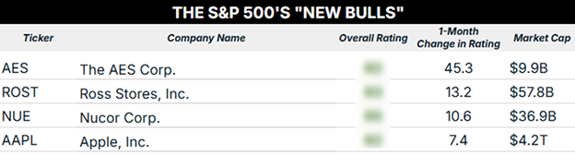

So, with that said, let’s take a look at the S&P 500 stocks that are newly rated “Bullish” (rated 60 or higher) this week. We’re looking for stocks that, ideally, are flying under the radar of most investors. That’s where the real upside is!  You’ll definitely see some familiar names making the cut this week.

Apple (AAPL), which is currently duking it out with Nvidia (NVDA) to be the world’s largest company by market cap, just moved from “Neutral” territory to “Bullish.

As a company with a $4.2 trillion market cap, Apple is perpetually punished on its size factor, where it rates a 2 out of 100. But it compensates by being one of the highest quality stocks you’ll ever find. It rates an exceptionally strong 95 on its quality factor due to its fortress balance sheet and ridiculously high profitability.

Otherwise, if you’ve been reading What My System Said Today recently, you won’t be surprised to see off-price retailer Ross Stores (ROST) on the list.

As I wrote last month,

Shoppers flock to discount chains like T.J. Maxx or Ross when their budgets are tight. With inflation still stubbornly high and the labor market looking a little shaky, this is exactly the kind of environment these chains are made for. Both stocks have been trending higher for months.

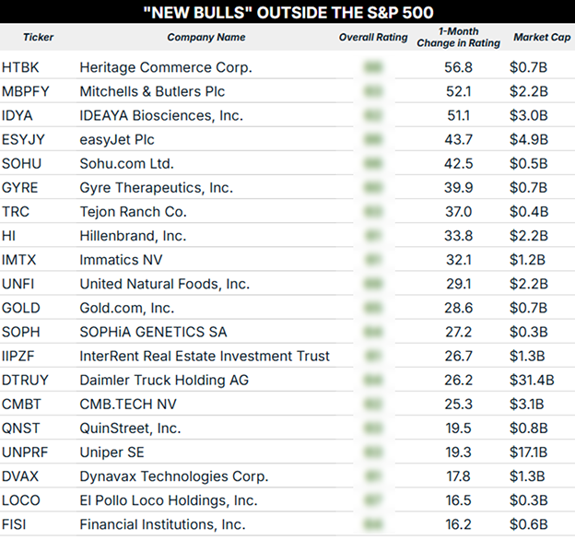

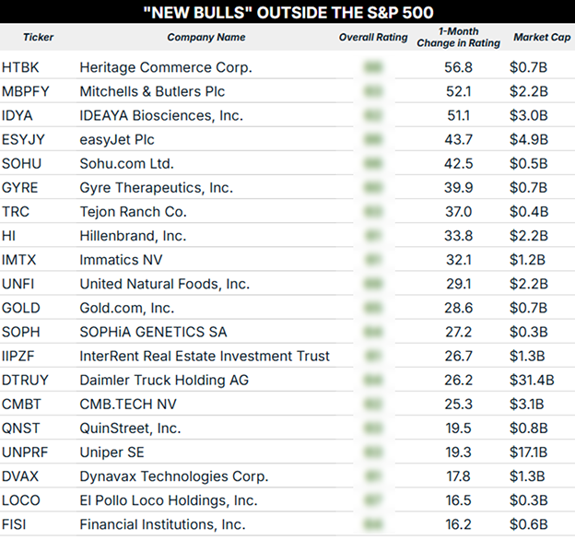

Ross has been trending higher since June and gapped sharply higher just before Thanksgiving. An Eclectic Mix Let’s cast the net a little wider and scan the list of newly “Bullish” stocks outside the S&P 500. I screened for the top 20 this week that had the highest one-month change in rating.

I like to look for patterns in the data. Are certain sectors trending more bullish? Certain countries? Product types?

This is good information to have as an investor.

Well, looking at this week’s newly “Bullish” list, there’s not much of a pattern to be discerned. It’s a jumbled mix of companies that is very consistent with a market in search of direction.

That said, I’ll highlight a few names that popped off the page for me.  Consumers may really be struggling right now with stubbornly high inflation, yet there always seems to be room in the budget for travel. Discounted European airline EasyJet (ESYJY) jumped a whopping 43.7 points over the past week and now rates as “Strong Bullish” with a Green Zone Power Rating over 80.

Chipotle’s CEO made waves back in October when he said that young professionals could no longer afford to eat the chain’s pricey burritos.

That may be true, but people do need to eat. And difficult economic times incentivize diners to trade down to more affordable options.

Considering that, I was interested to see the Mexican grilled chicken chain El Pollo Loco (LOCO) make the list. LOCO is a small cap value stock that scores particularly well on its size and value factors.

The shares struggled earlier this year but have been trending higher since October.

And finally, Tejon Ranch (TRC) caught my eye after it jumped 37 points over the past week and into “Bullish” territory.

Tejon is a diversified real estate development company with extensive businesses in ranching, farming and oil and gas royalties, among others.

The shares had a setback starting in July but have been trending higher over the past two months. And if you’re looking for something about as far from tech as you can get, a ranching and real estate company might be just what you were looking for.

To good profits,

Adam O'Dell

Editor, What My System Says Today

| He’s been mocked by Wall Street, labeled the “Prophet of Doom” — yet his forecasts have proven right time and again. Now, after correctly calling Trump’s 2024 win, Biden dropping out, and the 2008 crash, he’s come out of retirement to sound his final alarm. His new video details the event he believes will unleash the most violent reversal in U.S. financial history.

If you own stocks, a home, or a 401(k), you must see this now. | |

Post a Comment

Post a Comment