You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. If This Guy's Right, We've Been Using the Wrong CompassSome late night reading gives me hope that we're about to have a bigger debate about the impact of fiat currency on economic inequality, stock market performance, and more.Market Update: We squeezed today off that 470 bottom on the SPDR S&P 500 ETF (SPY), and key support levels. No monetary policy changes or updates to insider buying activity would suggest that, in this part of the cycle, the worst is over. But Goldman Sachs (GS) bottom call on software has bought some time. We’re heading into the back half of a financial cycle, and technology will still face pressure. The S&P 500 is still in a negative channel. This would qualify as lower highs… We’ll see if it can break out of its negative channel on Monday, but it’s going to take more than narrative. We remain committed to choke points, pipelines, consumer defensive stocks, and four-year, higher-quality corporate bonds and funds. Dear Fellow Traveler: A reader left a comment on my Bitcoin article last night. I didn’t recognize his name. So, I clicked on his Substack profile… you know… just to see who's at your door, to make sure they’re not selling something or serving a subpoena. This gentleman holds a CFA and graduated from the London School of Economics. And the papers he was carrying include a 60-page working academic paper on SSRN titled “The Debasement Index: Inflation’s Missing Twin.” It took me a second to see what Vincent Bühler was trying to do. He created his own Debasement Index to measure how much of our currency is just evaporating into the plumbing of finance. And when I read it, I stayed up staring at the ceiling for an extra hour. A question I always ask is simple. If the money printer has been humming for several years, and the government tells us that inflation is just 3%, where the hell has the rest of all that money gone? Vincent’s answer is “into your portfolio.” Not in the way we’d hope… and he’s got the math to make his case. Back of The Napkin… Nah... The Whole Bar.To measure his debasement index, Vincent uses a simple formula: Debasement Index = Monetary Aggregate / Real GDP You measure how much money there is… using broad measures like M2 or M3… and divide it by the economy's real output. If that ratio goes up, the currency is getting diluted. It’s not because bread and meat cost more money. It’s because there are more monetary units chasing economic output. He defines this as debasement. It’s not a measure of inflation, but a distinction that tells us what’s happening to the money itself. Inflation is a measure of consumer prices. You must think of CPI as a thermometer. The Debasement Index is more like a financial blood test. It’s measuring the condition of the currency, not the symptoms at the grocery store. This Number Should Make You PauseBühler measured this formula across 314 years of data in Great Britain. The Pound Sterling is the world’s oldest currency, offering one of the longest datasets available. That matters. He then identified four distinct monetary regimes by running structural break tests on the data:

Remember, that’s not inflation. That’s monetary dilution. It’s the result of the money supply growing faster than the economy can absorb. Every single year since 1971. You’ve been told the hurdle rate is 2%. That’s the Federal Reserve’s inflation target. Your broker talks about that figure in a financial plan. Everyone who has done a Monte Carlo simulation can remember this number, even under the worst hangover. Here’s the problem… If Bühler’s framework holds, the true long-term hurdle rate might be closer to the debasement rate than the CPI target. In the UK, that’s been about 6.7% since 1971. In the US, depending on your timeframe, it’s been closer to 4%. That money market account at 4.5%? If you accept debasement as the benchmark, then a 4.5% yield may not fully offset monetary dilution and the associated inflation. Your bond allocation? The framework implies that low-yielding fixed-income assets may struggle to keep pace with long-term debasement. Bühler’s preliminary data suggests bonds barely break even after debasement in developed countries. Nobody moved the finish line. They may have just been measuring the wrong one. Your Brokerage Account Needs a ReframeHere’s the part that made me smile… after crying a little. Bühler broke down long-term stock market returns into three pieces:

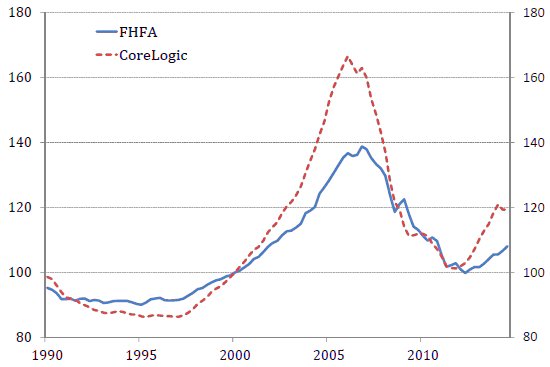

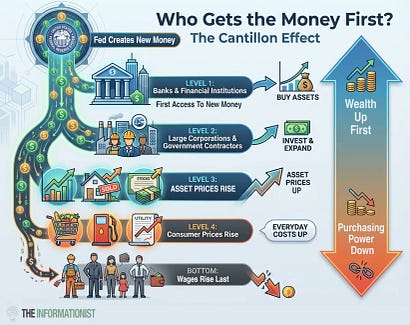

The S&P 500 has returned about 9.5% a year over the long run. Bühler derives this by decomposing returns into debasement, long-term trend, and speculative components. Given roughly 4% annual debasement of the US Dollar since 1900, that means about 40% of the total return is just the currency getting smaller. Four out of ten points. That portion isn’t driven by earnings growth or productivity. It reflects the monetary expansion component of returns. Your portfolio figures aren’t wrong… but depending on how you measure monetary dilution, you may not be as rich as you think you are. It’s like finding out your house “appreciated” 60%, and then learning that a big chunk of that was just the dollar losing value. You didn’t get richer. You got NOMINALLY LARGER. There’s a big difference between the two, and that gap compounds. Winners in The GapDebasement and inflation are related, but they’re not the same thing. The gap is the monetary dilution that doesn’t show up in consumer prices. And if Bühler’s framework is right, this is where a quiet wealth transfer originates. That gap flows into assets. Here’s the recap: high excess debasement compared to inflation in the early 2000s, leading up to the Global Financial Crisis. Banks created massive amounts of capital that flowed into the shadow monetary base. Mortgage lending swelled, but consumer prices were fine. Housing prices, on the other hand? You remember. After 2020, we had the biggest peacetime money creation in history. Asset prices moved immediately. Inflation took one to three years to show up at the store. By then, asset holders had already moved first. Bühler plotted this gap. He measured debasement minus inflation… against the UK Gini coefficient, a standard measure of inequality. Turns out the two move together more than you might expect. Correlation isn’t causation. But it’s uncomfortable, especially for policymakers. The mechanism he describes is consistent with what economists call the Cantillon Effect… Money enters the economy through pipes, not rain. Asset owners get the debasement premium first. Wage earners get the CPI adjustment later. The spread between those two numbers may represent a silent transfer from people who earn money to people who own the things money chases. Bühler is careful to note that many factors drive inequality… Those factors include demographics, regulation, and technology. But his data suggests monetary debasement should be considered as a contributing factor, not dismissed. Maybe someone in Congress will put two and two together… A Few Notes…Now, remember, this is a working paper, not a finished doctrine. Bühler isn’t arguing CPI is fake. He’s arguing CPI doesn’t measure everything money does. Debasement is about monetary expansion relative to real output. Inflation is about consumer prices. Sometimes they overlap. Sometimes they don’t. The paper itself lists meaningful limitations… For example, GDP measurements can be wrong, and any inequality analysis is a correlation, not a proven causal link. Bühler explicitly calls this an invitation to collaborate, critique, and improve the framework. Challenge accepted… I’m also sharing this to invite others to do so, and because the core question deserves a wider audience, not because it’s settled science. If he is right, we might have been eyeing the wrong scoreboard. But if you already understand that liquidity is the market, you’re positioned to think about this clearly. If Bühler’s framework holds, it should change how you think about what you own. Next time your portfolio is up 9%, and you feel good about it, consider subtracting the debasement rate… and the inflation rate. What’s left is your real return after the currency finished shrinking around you. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment